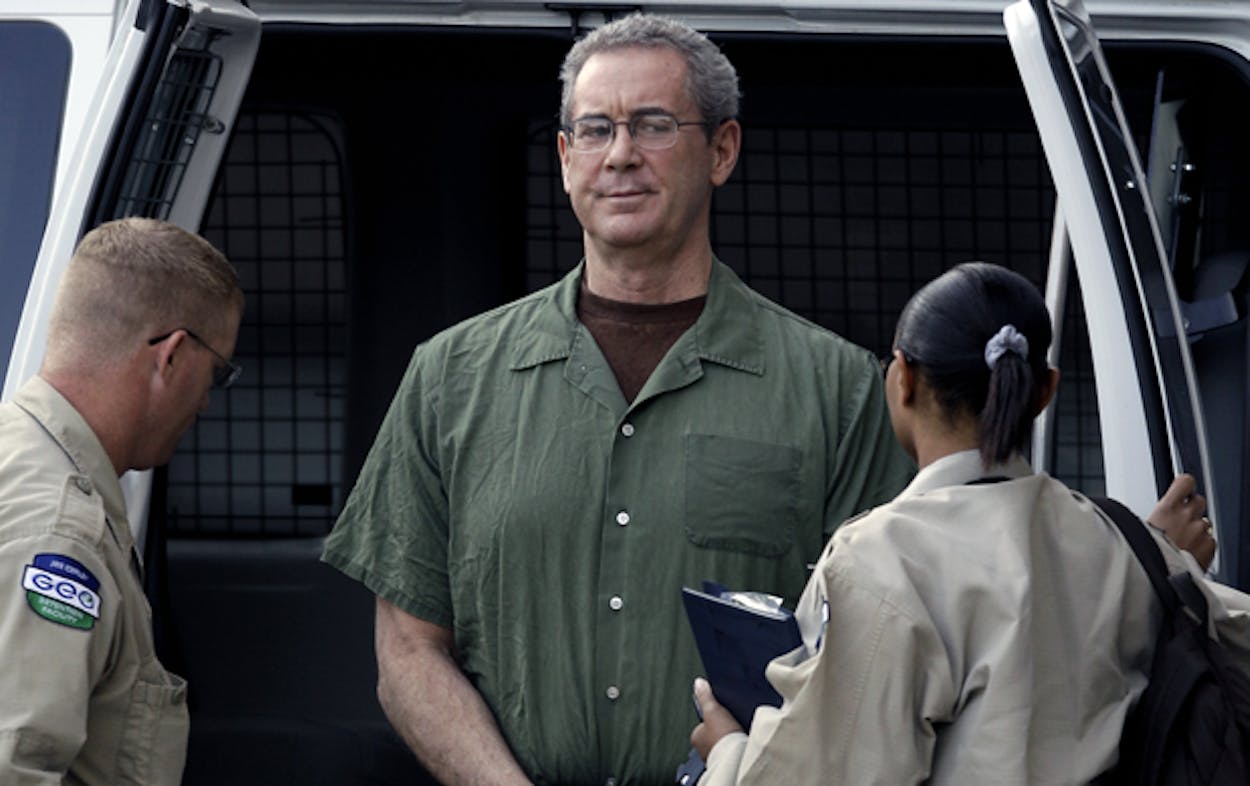

R. Allen Stanford can now officially be called a Ponzi schemer, after a federal jury found him guilty of fraud Tuesday for orchestrating a multibillion dollar Ponzi scheme over two decades. He now faces a life sentence.

After a week of deliberations, jurors convicted Stanford on thirteen of fourteen counts of fraud. Stanford swindled his investors, who numbered more than 30,000, by issuing $7 billion in bogus high-interest certificates of deposit from his Antigua-based Stanford International Bank. His elaborate Ponzi scheme ultimately stretched to 113 countries.

Stanford bankrolled his extravagant lifestyle by skimming $2 billion off the top for himself. “Federal prosecutors said Stanford was taking $1 million a day out of the Antigua bank by the end of 2008,” the Houston Chronicle‘s Terri Langford reported.

Clifford Krauss of the New York Times was in the courtroom to observe Stanford’s body language as the verdict was read: “Mr. Stanford listened to the verdict silently, barely tilting his head down while closing his eyes. His mother and other family members wept, while investors watching in the gallery cried while expressing relief,” he wrote.

Testimony from James M. Davis, Stanford’s college roommate turned chief financial officer, was key in securing the conviction, Krauss reported. Davis told the jury about bribes paid to Antiguan officials, steps taken to foil federal investigators, and moves made to reassure investors of the bank’s legitimacy. FBI agent Robert Martin testified about how federal investigators discovered the money trail between the bank and Stanford’s Swiss bank account, Langford wrote.

The only charge the jury did not bite on was a count of wire fraud, according to a tweet from Langford, who was livetweeting the verdict and the forfeiture hearing following it from the federal courtroom in Houston.

One investor, Houstonian Cassie Wilkinson, told the Houston Chronicle‘s Lindsay Wise she wept when the verdict was read. “As an investor you have to doubt whether you were just stupid or whether you were just taken advantage of, and this kind of relieved that doubt,” Wilkinson said.