The first thing to know about the Federal Reserve Bank of Dallas is that you should get there a little early. Security is tight—the entrance to the parking lot alone employs a series of three gates, plus guards. To enter the building you have to get a visitor’s badge, which allows you and your bag to go through the metal detectors into the lobby, where you can exchange your first badge for another one. This badge allows you to proceed beyond the lobby, although you’re not exactly free to roam. The reason for all the security is that in the basement of the Dallas Fed there’s a vault the size of a five-story building, and sitting in that vault, under heavy protection, is the most staggering concentration of physical wealth in Texas: trolleys full of shrink-wrapped bundles of brand-new bills, piles and piles of old bills, stacks as far as the eye can see. The exact amount fluctuates, but on any given day, there are billions of dollars down there. And all of it’s in cash.

Take the elevator in the other direction and you’ll find floor after floor of the same types of workers you’d find at a commercial bank: managers and analysts and researchers and lawyers. But these men and women (more of the latter than you might expect) are part of the Federal Reserve System, so they have a public role: they produce research about the region, serve as our friendly local central bankers, and, as a group and along with the Fed’s board of governors in Washington, help make decisions about how much money the richest nation in the history of the world should have on hand.

The twelve regional banks of the Federal Reserve System, which was created by Congress in 1913, are actual banks, but since their customers are other banks, as opposed to people or businesses, they tend to be supersized. The Dallas Fed isn’t the biggest of these regional banks—that would be the New York Fed, naturally—but it is unusual, because of geography. It’s the only Fed bank with a district that’s basically just a single state, and since that state is Texas, the Dallas Fed has a long tradition of being a pain in the ass. Historically, the president of the Dallas Fed tends to be one of the more maverick figures in the country’s financial system, given to plain talk and fiscally hawkish views.

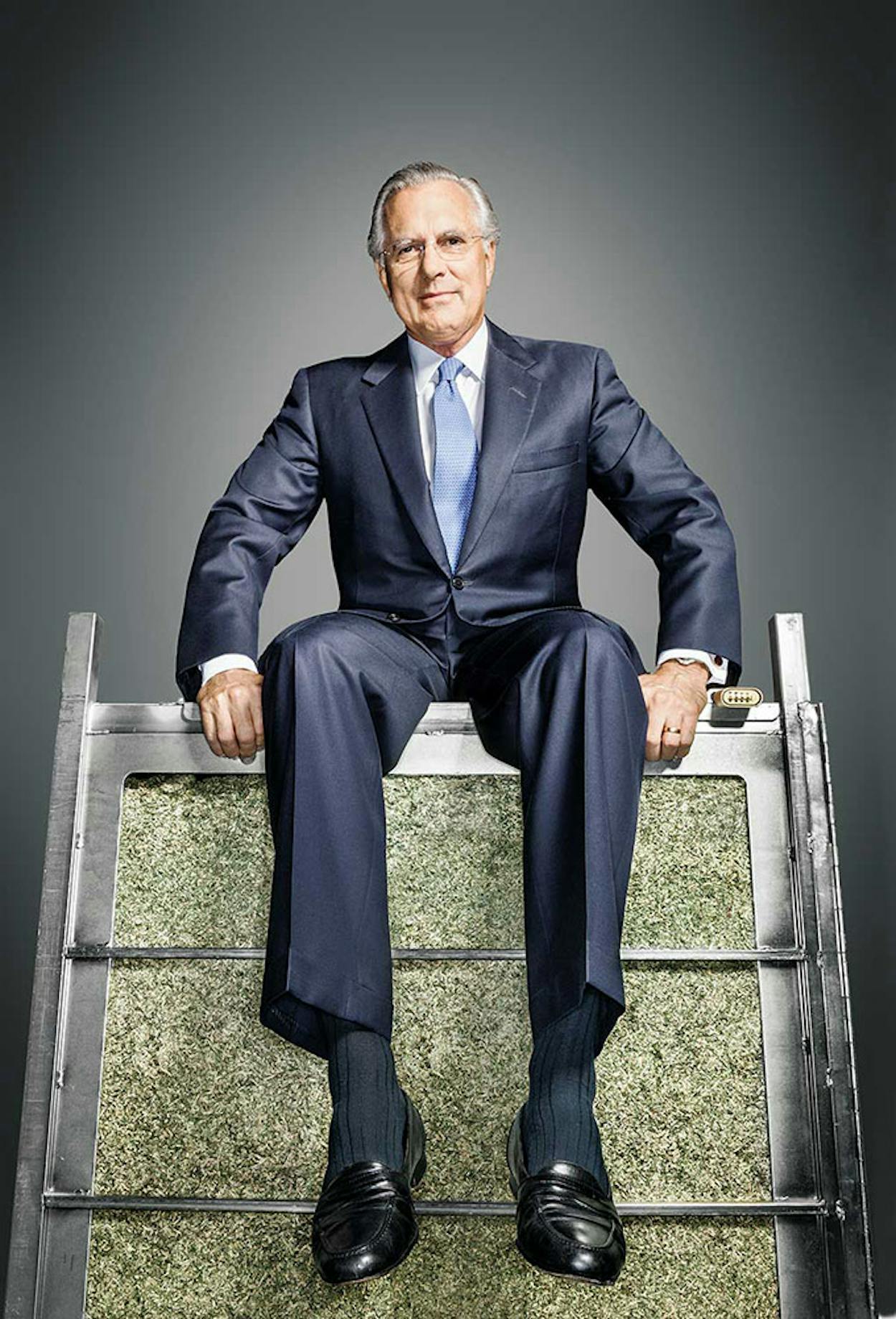

And that brings us to the top of the building, where we find the Dallas Fed’s current president and CEO, Richard W. Fisher. He has been running the operation since 2005, and during that time he has emerged as perhaps the most visible in this long line of Dallas Fed dissidents. To begin with, Fisher has more personal power and privilege than most Fed presidents. His reported assets were worth more than $21 million in 2010, according to annual financial disclosures the Federal Reserve released last year. And he is extremely well connected. From the window in his office, you can look down at Dallas’s new Klyde Warren Park, which includes the Nancy Collins Fisher Pavilion, named after his wife, the daughter of longtime Dallas congressman Jim Collins. Fisher’s pal Ray L. Hunt, the former chairman of the Dallas Fed’s board, recruited him for the job, and his golf buddies and friends include Exxon Mobil CEO Rex Tillerson, AT&T CEO Randall Stephenson, and George W. Bush.

All of that gives Fisher a particular profile, but much of his clout derives from the strength of the economy in his state. Of the many Texans who have taken issue with the economic policies coming out of Washington lately—a certain governor and freshman senator spring to mind—Fisher is probably the most credible. His office actually produces much of the fiscal data that politicians use to brag on Texas, so he has a more complete picture of our economy—and how it stacks up against the national economic performance—than most partisans on either side. Fisher is not elected, he has no direct power over Congress, and he’s not a politician, so he’s insulated from partisanship. In other words, he has no reason to play politics with the numbers.

This fall marks five years since the Wall Street meltdown that plunged the country into the most serious financial crisis since the Great Depression. The recession technically started in December 2007, but it wasn’t until September 2008, when Lehman Brothers declared bankruptcy, that everyone snapped to attention. Lehman was, at the time, one of the biggest banks in the country, and its operations were vast, varied, and global. For a bank that size to fail meant that things had gone very awry, not just at Lehman but throughout the American economy.

The collapse came at a critical moment in politics—the end of George W. Bush’s presidency and the final days of the Obama-McCain race—but Republicans and Democrats (mostly) put aside their differences long enough to bail out the banks, as well as the faltering auto industry. Fisher was among the fiscal conservatives who supported those programs as part of the emergency effort to stabilize the economy. Since then, however, he has been a vocal opponent of the “too big to fail” mentality, which strikes him as dangerous, even un-American. And while the prevailing wisdom among Democrats has been that the government should do more to help kick-start the economy, Fisher has maintained that it’s done more than enough.

In arguing this point around the Fed table, Fisher is armed with a key fact: the state of Texas has done hardly anything, and it has a dynamic and growing economy. When I went to see him, on a scorching morning in August, he wanted to show me the latest analysis from Pia Orrenius, one of the economists downstairs. (Full disclosure: Since 2012 I’ve been a member of the Emerging Leaders Council at the Dallas Fed, a group of young professionals who meet periodically to discuss industry conditions.) Orrenius had put together charts showing job creation by income quartile—a term Fisher prefers to “class”—in Texas, the United States, and the United States without Texas. Texas was beating the United States in every category. It is crucial data, Fisher said, because workers in the middle two quartiles, or what other people might call the middle class, are the backbone of the country, and helping them should be Washington’s absolute top priority. “Jobs,” he said, “are the route to dignity.”

Which brings us to another reason that Fisher has emerged as one of the more persuasive critics of well-meaning big-government interventions: unlike many rich people, he was born into poverty. On the day his mother went to hock her wedding ring, when they were living in Florida, they rode the bus to the pawn shop. He still remembers that the woman sitting in front of them had stored her chewing gum behind her ear. A few years before that, his family had been scraping by in Mexico. His dad sold tools, clothes, cars, whatever he could swing. At the Catholic school Fisher attended, the nuns would routinely beat him for his unkempt appearance. He was dirty because on the way to school he would often stop at the tortillería for breakfast—two tortillas rolled around a stick of butter, which usually left him with oil all over his shirt. “Sucio! ” the nuns would scold him, applying their rulers with relish. His knuckles still bear the marks.

Fisher’s unusual life story really begins with his father, Leslie, who was born in Queensland, Australia, in 1904. Leslie’s mother did not stick around, leaving the boy in the care of his father, although to call it “care” would be an exaggeration. In 1910 the pair was picked up for begging. The father was released, and Leslie was sentenced to seven years in the Westbrook Reformatory School. After just a few weeks, however, he was sent to an orphanage and from there placed with a series of families, who often treated him brutally. Eventually, despite the fact that at one home, he was tied to a post by the ankle at night, Leslie escaped. He lived on the street until age nineteen or so, at which point he made his way to South Africa, where he married a Norwegian woman named Magnhild Andersen. The couple decided to try their luck in America, but when they arrived, Leslie was denied entry due to a quirk of the immigration bureaucracy (Magnhild was allowed to stay). His wife settled in a boarding house in Los Angeles, and Leslie found work as a bookie across the border in Tijuana (he never made it past elementary school but was always good with math). Today, among the photos and mementos in his son’s office is a crumbling sheet of blue paper from 1941, a receipt for the “head tax” Leslie paid each time he traveled across the border to visit his wife and his children, the first of whom was born in 1941.

Fisher, the youngest of three brothers, was born in 1949. In a twist that seems oddly fitting considering his later career, Fisher was conceived in Shanghai, where his father had traveled (along with Magnhild, who was called Babe) to collect a debt. The Fishers departed China on one of the last ships to leave before Mao closed the port; their luggage included two suitcases stuffed with American dollars.

Shortly after their third son was born, in Los Angeles, the Fishers moved to Mexico City. Fisher remembers his father as a natural salesman and an extremely tough guy but someone who struggled to keep a job. He worked briefly as a salesman for a German company, but since he spoke neither Spanish nor German, Fisher said, “it didn’t go very well.” Around 1960 Leslie was finally granted entry to the United States, and the family moved to Florida. Fisher, who was eleven at the time, spoke Spanish better than English, so he was held back a year in elementary school. But this also gave him his first lucky break. Among his classmates were a number of Cuban children, refugees from the revolution in 1959. The school’s principal was unable to communicate with these children, so he informally deputized Fisher as a translator, rewarding him with perfect grades in return. The result was that when the family moved again, back to California, Fisher’s academic record was good enough to land him a spot in his new junior high school’s experimental program, in which seventh and eighth graders studied Yale University’s math curriculum. His father, with the facility for numbers that had served him as a bookie, helped him study at night, and Fisher did well enough to win a scholarship to boarding school at the Admiral Farragut Academy, in New Jersey.

From that point on, Fisher’s trajectory becomes slightly more typical. He played football and worked in the summers at a local greasy spoon. After graduation, he was accepted to the U.S. Naval Academy, where he spent two years before transferring to Harvard. From there he went to Oxford, a feather in his cap that his father, as an Australian, especially enjoyed. During his time there, amid the dreaming spires, Fisher met his future wife at a reception for American students hosted by her father, the congressman from Dallas. There were about thirty men there, as Fisher recalls, and a girl he had been noticing in his classes. She turned out to be Nancy Collins. The next day the elder Collins invited Fisher to another event. “Congressman,” Fisher said, “I think the odds are pretty bad.” Collins cheered him up: it would be just the three of them. Soon it was only two.

The couple moved to California, where Fisher went to business school at Stanford, and then on to New York, where he began his career as a banker. Their first son, Anders, was born in 1976, and around that time Fisher had an epiphany. He had taken Anders to Ellis Island, and on the way back, as he stood on the deck of the ferry, gazing at the Statue of Liberty, his son in his arms, the dazzling lights of Manhattan beginning to twinkle in the early-evening half-darkness, a thought came to him clearly: “I’ll never make it here.”

He wanted to move the family to Texas. Nancy didn’t want to go back to Dallas, so she campaigned for Houston. But Fisher made a strong case for her hometown. In the seventies, he said, it was the kind of city where you could succeed even if “you had the brains of a squirrel.” His reasoning carried the day, and the family moved to Dallas, where Fisher opened his own investment firm. After a brief stint as assistant to the Secretary of the Treasury during the Carter administration, he settled in and worked more or less quietly for the next couple of decades. Then, in 1994, he made a decision that he’s often described as the result of a midlife crisis: he challenged Kay Bailey Hutchison for the U.S. Senate seat.

National observers might be surprised to hear that Fisher ran as a Democrat. As an icon of fiscal hawkishness, he’s usually assumed to be Republican. Texas Democrats, though, are traditionally pretty conservative on fiscal issues, and in the mid-nineties there was still a fair amount of overlap between the two parties. Fisher’s father-in-law was himself the son of legendary Democrat Carr P. Collins, but as Fisher recalled, “he was the second-most-conservative man in Congress. Voted against every spending bill that ever came up.” For that matter, some of the state’s top Republicans were repurposed Democrats, such as Rick Perry, who was reelected agriculture commissioner in 1994.

By all accounts, including his own, Fisher didn’t make much of an impression on the people of Texas. Hutchison was reelected in a twenty-point landslide, which was more than double the margin that Bush posted against Ann Richards in the gubernatorial race. It didn’t ruin Fisher’s reputation, though. He simply resumed his well-connected life in Dallas. At the end of the decade, he spent four years as deputy U.S. trade representative, working on the implementation of NAFTA and the admission to the World Trade Organization of both China and Taiwan. He had moved on to a job with Henry Kissinger’s consulting firm when Ray Hunt came calling, looking for a replacement for then-Fed president Robert McTeer. Fisher’s international experience, and the fact that he was bilingual, were selling points. The Fed’s board also thought he would be a suitable representative of the dawning new age. McTeer was a cowboy poet, and he was leaving the Fed to become chancellor of the Texas A&M University System. Fisher was more cosmopolitan, more refined. As W. Michael Cox, one of the bank’s senior economists, explained in a Dallas Morning News story about the new Fed president, “We’re changing in our nature from being cowboys and oilmen to being high-tech, smart innovators. Richard fits that image very well.”

Fisher became president and CEO of the Dallas Fed in April 2005—and promptly sparked his first controversy. The slightest indication about how the Fed plans to tinker with monetary policy can set off a stampede, so most people who work there learn the art of speaking without saying much. This has never been Fisher’s strong suit. In an interview in June 2005, he came right out and predicted that the Fed would stop raising interest rates. “Reactions to Fisher’s comment,” reported one East Coast paper at the time, “ranged from a jump in stock prices to wrinkled brows on the foreheads of numerous economists.”

Fisher, it quickly became clear, also had a knack for colorful anecdotes, which he often drew from time spent on his ranch, in East Texas (the family leases out most of the grazing land but keeps a few dozen Longhorns for breeding purposes and rhetorical flair). A good example of this comes from a speech Fisher gave last year, in which he explained to a group of North Texas businessmen and women that his breeding bull, Too Big to Fail, has “plenty of liquidity at his disposal” but that the bull couldn’t do his job if there was a fence between him and the cows. American businesses, he continued, are faced with a fence of their own—a “fence of uncertainty.” The talk got a mixed reception. “Some people in Washington were aghast,” he told me later, but he had received a nice message from one of the cattle ranchers in the audience, who said that for the first time he understood monetary policy.

Few people, it must be said, really do. A century ago, Congress realized that monetary policy was too contentious, too important, and possibly too confusing to be handled by congressmen. So it created the Fed. The Federal Reserve Act established twelve regional Federal Reserve banks to oversee qualified member banks in their districts. The regional banks themselves are largely autonomous in regard to daily operations. Each has its own president, like Fisher, and the presidents, like the CEO of any private bank, can be fired only if the regional bank’s board votes to remove them. In addition to the twelve regional presidents, there is a Federal Reserve Board in Washington, composed of seven bankers appointed by the president and confirmed by the Senate. This board, along with the president of the New York Fed and four reserve bank heads who rotate on one-year terms, constitute the Federal Open Market Committee, which makes the decisions about monetary policy. Nonvoting or alternate members attend meetings but are not technically committee members. Fisher is currently an alternate member, so he gets a seat at the table, but he won’t be eligible to vote until 2014.

The simplest way to explain what the Fed does is to say that it stabilizes the country’s money supply. This is done by managing currency, overseeing member banks, deciding the interest rates at which the government can borrow or lend money, and, when necessary, making the purchases or loans that private banks will not. To put it another way, the Federal Reserve often acts as a counterweight to looming problems in the private sector. If private players are getting too optimistic, racking up debt, and risking inflation, the Fed may move to raise interest rates, thus tightening the money supply. If, on the other hand, the private banks are too spooked to do much of anything, the Fed can lower interest rates to encourage lending or even act as a sort of substitute, spending money when no one else will.

This last activity has caused a fair amount of debate over the past five years. Since the financial crisis hit, the Fed has intervened several times to make large-scale asset purchases, a move known as quantitative easing. It works like this: If commercial banks have assets they can’t readily sell, they end up in a defensive posture, unwilling or unable to buy anything else. So the Fed buys up huge batches of securities, in the hopes of creating a ripple effect among the private banks, which would enable companies to get access to much-needed credit, restructure their liabilities, make new investments, and above all, put people back to work.

Most countries in the developed world have a central bank like our Federal Reserve. It’s a useful thing, but Americans have historically been torn about whether or not to have one. The bank’s weird, quasi-public nature means it has expansive powers and unusual independence; dissolving the Fed, or at least auditing it, is among the recurring demands of the tea party movement, although the idea attracts support from progressives too. Others support the system in general but frequently disagree with what the Fed is doing.

Fisher is in that camp. A constant theme of his speeches since the downturn hit is that the central bank is there for a reason, sure, but the American economy works best when businesses are largely unfettered and even allowed to fail spectacularly; only then can the United States remain the kind of country where butter-shirted young boys can still pull themselves up by their bootstraps.

As in any system, the trick is finding the right balance. When I asked him about the financial crisis, Fisher told me that by the fall of 2007, he was feeling seriously worried. “Mortgage-related markets were manic,” he said, and big banks like Bear Stearns and Merrill Lynch looked as if they were in trouble (both were sold in 2008). “I don’t think I got a full night’s sleep for eighteen months,” he recalled. Behind closed doors, the Fed was in a state of high alarm, and he would either be awakened by a middle-of-the-night call from one of his counterparts or be already lying awake, wondering if the actions he’d advised were the best ones.

When the crisis did blow open, Fisher’s public commentary was temperate. In October 2008 he gave a speech in Washington counseling calmness. Countries have weathered crises before, he said, and America would weather this one. In his view, the Fed had to resist providing undue comfort to foundering companies who had run into trouble through their own misconduct or ineptitude. To do so would create moral hazard, the risk of encouraging similarly bad behavior in the future. At the same time, Fisher argued that the Fed’s response should be muscular.

“I supported all the emergency programs we put together,” Fisher told me. “We didn’t do anything different than what the Bank of England did in response to the Panic of 1825. We just did it in a modern context. We stepped in and became the market maker to restore the markets. If markets don’t work, if you can’t go borrow as a businesswoman or use the basic instruments that finance your inventory or the transit of your product and so on, you can’t conduct commerce. And if you can’t conduct commerce, we have depressions.” The monetary authorities had taken drastic measures in the immediate response to the crisis, as had Congress, and Fisher had been in favor of both actions. He had voted for the Fed’s first round of quantitative easing, and he had expressed support for the Troubled Asset Relief Program, the bank bailout signed by President Bush.

“I think we did that well,” Fisher continued. “My dispute has been with what we did afterward.”

After the chaos of the crisis itself, that is. Since 2008, the Federal Reserve has continued to run what economists call an accommodating monetary policy. Interest rates have been low, and the central bank has gone through two subsequent rounds of quantitative easing. About this, Fisher simply said, “I’ve been disappointed.”

When I asked him to elaborate, he explained that he had been “thinking around the bend, trying to understand what the consequences were.” After looking at the problem that way, he said, “I couldn’t go along with doing what we were doing, because the consequences of undoing what we were starting to do were going to be negative.” He gave me a list of reasons why he had regularly dissented from the Fed’s recent policy decisions. First, in Fisher’s mind, those policy decisions have not been working: while the national economy has improved since 2008, the recovery has not been as rapid or as thorough as anyone would like. Second, after three rounds of quantitative easing, the Fed is holding a lot more securities than it used to, and it presumably doesn’t want to hold them forever. “We learned that from the Hunt brothers,” he said, referring to the time Bunker Hunt and his brother Herbert led an effort to corner the world’s silver market, in the seventies, leading to two of the largest bankruptcy filings in U.S. history. “You can buy all you want, you can corner a market, but when you want to get out of it, it’s a different story when you’re on the sell side.” Third, an accommodating central bank is a meddlesome one, and the Fed has attracted enough criticism since the crisis that its independence has been threatened. And fourth, the Fed’s extremely low interest rates have enabled the government to run whopping deficits (though they have begun to come down).

“I lost that argument,” he continued. “But incidentally, I wasn’t alone. I’m not allowed to speak for others, but there were others at the table—and as we go through time, there are more—who agree, who question the efficacy of this.”

It seemed to me that it’s one thing to question the efficacy of a policy and another to say that the policy’s consequences, like enabling the government to run huge deficits, will be negative. Efficacy can be assessed. Future consequences are undetermined and also somewhat subjective.

“Well, the costs we knew going in,” said Fisher. “Hardworking people who had saved their money and done the right thing were going to get hammered, because interest rates went to zilch.” Baby boomers about to retire, for example, wouldn’t see the returns they had been expecting in their retirement accounts. “And then we knew there would be some outright screaming benefits. Warren Buffett gets infinitely richer. Why? Because money is free and he has access to it.”

The contention that it’s not good for wealth to be increasingly concentrated among fewer and fewer Americans is one that people might expect to hear from an Occupy protester rather than from a millionaire banker who raises Longhorns, but Fisher has made it before. “We made it easy for the rich and the quick, the very sophisticated,” he told me. “What have we done for those two middle-income quartiles, for the men and women who work?” The Fed’s actions, he continued, have helped companies, particularly large companies, restructure their balance sheets and refinance their debts on better terms, but the companies have not resumed hiring in the way that policy makers hoped.

Every few months, Fisher calls a couple dozen CEOs to ask them how things are going. He told me that when he asks this informal focus group why they haven’t been hiring more quickly, they tell him that they want more clarity from Washington, about what their tax rates will be, about what federal spending will look like, and about what it will cost to implement new laws like the Affordable Care Act. And so the problem, in Fisher’s view, is with Congress and the president, who haven’t done enough to mitigate the uncertainty constraining the private sector.

“I never get into the specific recommendations, because I’m not an elected representative, but I would like to see [job creation] as the principal guideline,” he said. “And I don’t care if they’re union jobs, nonunion jobs—I don’t care. All I care is that business be taxed and federal spending be conducted and regulation be crafted so that it incentivizes businesswomen and men to go out and hire.”

This is, Fisher had said a few moments before, why Texas has done so well. “We have been more pro-business than the rest of the United States.”

“You just said you don’t want to give policy recommendations,” I told him, “but when you cite Texas as a good example, a certain set of policies comes to mind.”

“Here’s the way I’d put it,” said Fisher. “I’d rather see the Texification of the United States than the Californification. California’s a beautiful place. I was born there, and I go out there often. It’s a stunningly physically beautiful place. But it’s an unhappy place. It sort of went past whatever that point is of balance. We’re the opposite extreme.” It’s true, he acknowledged, that Texas produces more low-income jobs than most states. But it also produces more middle-income jobs than most states, and more high-income jobs too. “The reality is, people come here to work,” he said. “Why else would they come here? We have crappy social services.” He went on. “Yes, there are drawbacks. We have more teenage pregnancies, et cetera. But again, I believe that jobs are the route to dignity, because I grew up in a family where we didn’t have that security.”

Fisher seemed to anticipate the next question. “There is a role for government, and there is a role for regulation, and where Texas showed that was in the regulation governing how much you could borrow against your home. That saved us.” He sat forward in his chair. “Now,” he said, with the polite tone of a man who has logged some time in tea party territory, “some people would say that interfered with a person’s right to borrow infinitely against their household. But it was wise. So, I’m not against government. What I want is—” He sighed. “I want prudent government that encourages job creation.”

The comment raised a final question: Would that be Fisher’s advice in general, or is it specifically because the country is still struggling to recover from the crisis? “I think in general,” Fisher said, after a pause. “We’re in a different world than we were before. We’re not the only player on the globe.” He explained that the crisis had commanded public attention in a way that globalization—the liberalization of markets around the world after the fall of the Soviet Union and the emergence of new competitors—hadn’t. Yet globalization would continue its inexorable march regardless of the economy’s recovery. “It’s a special point in time, but that’s not just postcrisis, it’s post–changing the world,” said Fisher. “It requires a new mind-set.”

I had the feeling he didn’t think that would be too hard to come by. Just one hundred years ago, Fisher’s father was an Australian urchin and Dallas was doing its best to win one of the newly created Federal Reserve banks. The city had fewer people than New Orleans, but it was, its boosters bragged, an international center of saddlery. What’s happened since—the billions of dollars in the basement, the fourteenth-floor views of a bustling downtown—surely seemed improbable then too.

- More About:

- Politics & Policy

- Business