Imagine there was a professional baseball team and only half its fans could see it win. Would the games still matter? For the Houston Astros, the worst team in baseball the past three years, the question has been moot so far—there have been precious few victories to witness. This season, though, fans may have more reason to watch. Hall of Famer Nolan Ryan is back with the team, as an executive adviser, and ESPN has declared the Astros’ rebuilt farm system the best in baseball. But finding an Astros game on a TV in Houston will be very difficult.

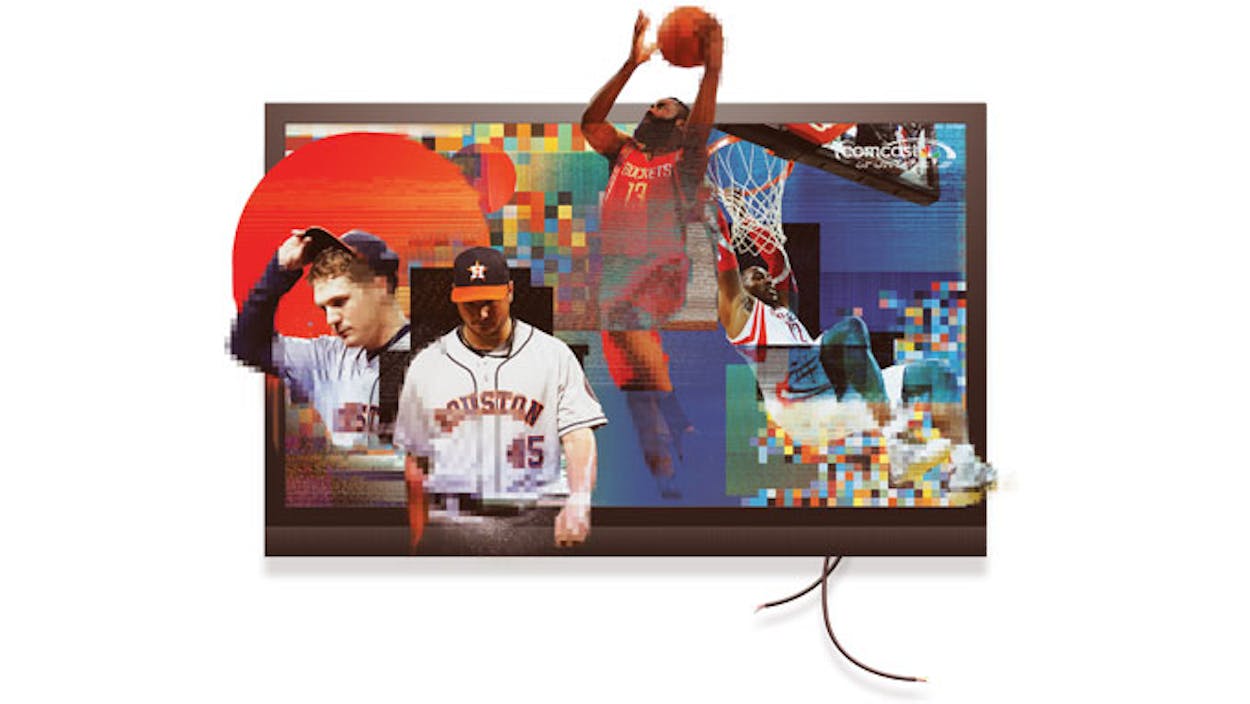

Comcast SportsNet Houston (CSN Houston), the network with the exclusive rights to broadcast Astros games, is in Chapter 11, and its three owners—the Astros (with a 46.5 percent stake), the Houston Rockets (31 percent), and the cable giant Comcast (22.5 percent)—are bickering over what to do next. Comcast plunged the year-old network into bankruptcy proceedings last fall after failing to shoehorn it into the lineups of providers such as DirecTV, Dish, and Time Warner, which are tired of jacking up the rates they charge to subscribers to pay for ever-more-specialized networks. As a result, Comcast itself is the only major provider that carries CSN Houston, meaning Astros and Rockets games—and Houston Dynamo soccer games—appear in just 40 percent of households with cable or satellite in the greater Houston area. “Both the Astros and the Rockets used to be staples in my home,” says Joseph Theis, a Houston restaurant owner and DirecTV subscriber. “Now they’re really not a part of my life.”

In many major markets, regional sports networks are the new profit centers for team owners, who are always looking to wring more revenue from their franchises. The Los Angeles Angels, for instance, signed a seventeen-year deal with Fox that brings in an average of $95 million in rights fees annually for the team. But without Time Warner and its brethren on board, CSN Houston found it couldn’t afford the Astros’ and Rockets’ licensing fees. And so, in late September, Comcast turned to bankruptcy court to preserve what little value was left in the network. The Astros immediately opposed the filing and have vowed to thwart any attempts to reorganize CSN Houston. The Rockets, by contrast, supported the bankruptcy and, given their status as a possible playoff contender, are eager to get the issue resolved.

How did these three parties find themselves in such a mess? Because of an impulse that’s as American as baseball itself: greed. Traditionally, professional sports teams have sold the rights to broadcast their games to a network or a local station, and Major League Baseball required them to share a portion of the revenue with the rest of the teams, in an effort to keep things equal among large and small markets. Those revenue-sharing rules, though, don’t apply to money a team collects from a regional network it partly owns. And so, in 2002, the New York Yankees and the New Jersey Nets launched the modern era of the regional sports network with YES (Yankees Entertainment and Sports Network), which the teams co-owned with the investment firm Goldman Sachs.

Cable companies have been eager to cash in too. Sports events are one of the few beachheads in cable’s battle against on-demand services such as Netflix. And live sports is one of the most lucrative areas for television advertising, accounting for about $11 billion annually. Regional networks represent the fastest-growing segment of this market. There are 22 regional sports networks owned by Fox alone; the company currently has an 80 percent stake in YES, which is now worth an estimated $3 billion.

The Astros, of course, are a far cry from the Yankees. Still, the idea of starting a network made sense back in 2005, when the Astros and the Rockets partnered with Fox on Fox Sports Houston, which made money for everyone involved. But in 2010 the teams, seeking an ownership stake, dumped Fox and set up shop with Comcast, which agreed to pay the Astros five times as much as Fox had—$80 million a year, for twenty years. Not to be outdone, Fox Sports Southwest cut a deal with the Texas Rangers, agreeing to pay a reported $150 million a year, for twenty years.

There are a couple of crucial difference between those deals. Unlike CSN Houston, Fox Sports Southwest (which also owns the television rights to Dallas Mavericks and San Antonio Spurs games) has been around for many years and already had deals in place with a number of providers. And though the Rangers own 10 percent of the network, Fox is the majority owner, with clear lines of authority and a lot of money riding on the company’s success. “You want your deal guaranteed by a third party with deep pockets,” says Don Erickson, the president of Dallas-based Erickson Partners, a sports valuation and advisory firm. Neither Comcast nor the teams have a majority stake in CSN Houston, and when it began losing money, none of the partners wanted to shoulder the costs.

CSN Houston’s bankruptcy filing has affected the city’s three professional sports teams differently. Because the Chapter 11 process began just as the baseball season was ending, the Astros haven’t yet felt the full impact of the partial blackout; as of late April they were owed $36 million in unpaid licensing fees. But the bankruptcy proceedings have stretched over the entirety of the basketball season; with their media fees suspended by the Chapter 11 process, the Rockets have argued that delays in the case are imposing “significant burdens” on the team—so far, $45 million in unpaid fees. The Dynamo, for its part, is staying out of the fray. It has no equity stake with CSN Houston, and the network has continued to pay the team’s modest licensing fees. “The filing has no impact on us,” team president Chris Canetti said. “We hope the legal action will result in the network’s getting the distribution it deserves.” For that to happen, CSN Houston would have to emerge from bankruptcy with a restructured fee scheme that would reflect the lower rates it can expect to collect from cable and satellite providers.

These carriage fees are the key point of contention with the Astros, and the team has a lot of incentive to drag the case out. Astros owner Jim Crane, who bought the team in 2011 from Drayton McLane, claims that as McLane prepared to sell the franchise, he urged Comcast to raise the carriage fees for the network. Comcast said the higher fees were unrealistic but eventually relented after persuading the owners to grant it “most favored nation” status. That meant if the network entered into agreements with other providers at lower rates, Comcast would be able to reduce its base rate to the same amount. In other words, Crane argues, Comcast asserted that the network could be marketed at a higher base rate, even though it knew it would probably have to settle for less.

Crane claims these maneuvers inflated the price he paid for the Astros’ stake in the network. Only after cable and satellite providers balked at the high rates did Crane come to the conclusion that he’d been duped. In a lawsuit he filed against McLane and Comcast last fall, he went so far as to play the fan card, saying he has been left with an impossible choice, to “either accept the broken network as is, and deprive thousands of fans the ability to watch Houston Astros games on their televisions, or distribute the games at market rates and take massive losses out of the Houston Astros player payroll—thereby dooming the franchise for years to come.” It’s something of a stretch to blame a regional sports network for the ruination of an entire franchise, especially one with the subterranean record of the Astros. Clearly, though, Crane is angry at Comcast for what he regards as its complicity in overvaluing the network. He’s also unhappy that Comcast placed the network in bankruptcy last fall, thereby keeping the team from terminating the company’s media rights. The Astros contend that any effort to reorganize the network is futile, and the bankruptcy judge seems to agree; he recently concluded that none of Comcast’s restructuring ideas would work.

By refusing to cooperate with the bankruptcy, Crane may be trying to force Comcast to raise his equity stake in the network—bringing it more in line with what he paid for it—and lower its carriage fees to entice more distribution. If Comcast refuses to deal, Crane can hold out, in hopes that the network will be liquidated, then take back the Astros’ broadcast rights and sell them to the highest bidder. That may be exactly what happens. On March 17, Comcast informed the bankruptcy judge that it wouldn’t submit a bid to buy the network, which is one option Chapter 11 gives the company.

Crane has every reason to wait for his pitch. If the team’s rebuilding program begins paying off, it may be able to attract more viewers and command higher licensing fees. “We believe what we’ve done with the team since our ownership took over puts us in a good position,” Astros general counsel Giles Kibbe says. He argues that Comcast wants to lock in lower rates before the team starts winning. “We’re not going to enter into a bad twenty-year deal. Our product is going to be great in a couple of years.” The longer the Astros can wait, the less dismal their prospects may look.

Crane, in other words, may be willing to bunt on the fees today, sacrificing CSN Houston to liquidation now with the expectation of garnering higher fees later. For a guy who’s new to the business of baseball, he seems to be executing a classic squeeze play.

- More About:

- Sports

- Politics & Policy

- Houston Rockets