Last November a group of geologists and engineers from Pennzoil’s headquarters in Houston were heading into the Gulf of Mexico to visit several sites where the company was drilling for oil. I met them in Lafayette, Louisiana, where Pennzoil has a branch office that oversees its offshore operations. We boarded a Sikorsky S-76 helicopter and flew over fields where farmers were burning sugar-cane (it was harvest time), over spongy marshlands, and then over the reddish-brown water of the shallow Gulf. The water near the coast was full of sediment dumped in by the Mississippi River, which is the great muddy secret behind the region’s oil-rich geology, but after a while, the water turned a semi-translucent green, the color of jade or marble, as the ocean floor dropped away and the sediment settled out. Then came the oil rigs, perched on the water like mammoth steel herons.

For the past 25 years Pennzoil has owned a handful of oil production platforms in the heart of a prolific oil field in the Eugene Island area, ninety miles from shore. We spent the night on one of them, the C platform, which serves as a kind of central facility for Pennzoil’s operations there—oil and gas from the other platforms are piped over, processed, measured, and sent to shore in pipelines that run along the bottom of the seafloor. That night, we climbed a flight of metal stairs up to the heliport pad, the highest place on the platform, to look around. The view was breathtaking: All the rigs and platforms had their lights on, and the busy Eugene Island field twinkled like a sprawling little city. The next morning, I went back up to the heliport to see how many structures were visible in the surrounding water. I counted 92, give or take a few things of indeterminate outline. We were in the middle of something that looked a lot like a boom.

In the past several years a combination of events has resulted in a surge in the amount of drilling in the Gulf. This is an unexpected reversal. Since offshore drilling began in the thirties, oil companies have drilled an estimated 35,000 wells in the Gulf and pumped out 12 billion barrels of oil and 130 trillion cubic feet of gas. But ten years ago, the oil industry collapsed overnight when the price of a barrel of oil plunged to $11, down from a high of about $40, sending the economies of Texas, Louisiana, and Mississippi into a tailspin. Locally, further contraction occurred when many industry geologists decided that the Gulf of Mexico was finished—it seemed as if all the sizable fields in shallow water had been found, causing one newspaper to call it “the dead sea.” Oil companies began pulling out, the price of leases dropped, and by 1992 only 497 wells were drilled in federal waters, down from 1,352 eight years before. Since the bust, the number of people working in the oil industry has been cut in half.

Things began to turn around in the late eighties. In part, the Gulf became more attractive as the alternatives proved disappointing: Years of exploration off the coast of Alaska yielded nothing of commercial size other than the giant field at Prudhoe Bay; new drilling in the waters off California was outlawed as a result of environmental concerns (ever since the Union Oil Company lost control of a well off Santa Barbara in 1969, which dumped 21,000 gallons of oil a day into the Pacific for twelve days, Californians have been leery of offshore drilling); some companies tried deep-water plays off the East Coast, but as Jim Funk, a general manager at Shell Oil, dryly recalled, “We successfully drilled some dry holes.” The main reason the Gulf became more attractive was that geologists began to understand it better after advances in technology solved some of the murky riddles hidden under the seafloor. Using 3-D seismic technology, geologists have discovered that many of the mature oil fields on the continental shelf contain an abundance of small reservoirs that had been overlooked. Pennzoil, for example, has tripled the amount of oil it produces from wells in the Eugene Island field, which are now flowing at the highest rate in twelve years.

As geologists continued to study the Gulf, they discovered that vast quantities of oil lay undisturbed beneath subterranean sheets of salt. In 1993, after drilling through more than half a mile of salt, Phillips Petroleum struck oil at a site called Mahogany and became the first company to begin development of a subsalt oil field. As much as 15 billion barrels of oil may lie below salt formations in the Gulf, and after the Mahogany discovery, other companies rushed back into the area. Meanwhile, Shell ventured out into the deep water, despite predictions that there was no money to be made there. Shell’s voluminous Auger discovery proved that large quantities of oil exist hundreds of miles from shore; it is estimated that the Gulf’s deep water may contain as much oil as two Prudhoe Bays, making the area viable for the few companies that can afford to spend $1 billion on a production platform and then wait years to recoup the investment. These three different plays—combing old fields for additional reserves, drilling below salt, and drilling in deep water—have made the Gulf once again the place where most oil companies are investing the bulk of their domestic-exploration budgets. The average number of rigs drilling new wells in the Gulf in a given week had dropped to 45 in 1992, but last year the figure climbed to more than 100, causing the day rates for rigs to soar. Some rigs now cost twice what they did twelve months ago. The prices of leases have rocketed upward, and drilling companies can’t satisfy the demand for their rigs because they can’t find enough experienced oil-field hands to man them.

You could almost say that oil is back. Yet this is not a boom in the 1981 sense of the word. Today the price of oil fluctuates between $15 and $20 a barrel, and every company drilling in the Gulf operates with a meager profit margin—if it is making money at all. Only after paring costs drastically have oil companies begun to show signs of vigor. Shell, for example, has cut its number of employees from 35,000 to 22,000 in recent years. There are no dentists from Midland jumping into these plays, and nobody is getting rich overnight. If this is a boom, then it is, as people in the industry say, a managed boom. There’s nothing freewheeling about it.

Before anybody drilled below salt or began producing oil from deep water, 3-D seismic technology created a modest rally in old oil fields in the shallow parts of the Gulf. For decades industry geologists have decided where to drill by poring over maps of subsurface formations created from seismic data. Offshore seismic data are obtained by shooting air guns underwater, then listening for the echoes reflected from rocks below the seafloor with electronic devices. The varying speeds at which sound waves return allow geologists to create images of the subterranean formations that reflected them. Two-dimensional seismic surveys have been used since the twenties, but 3-D surveys only became feasible in the eighties, with the advent of more-powerful computers. These surveys consist of many 2-D surveys put on top of each other, so that the height, as well as the length and breadth, of formations can be delineated. Today geologists can generate the image of a cube, representing a volume of the subsurface, and then revolve the cube, or slice away sections of it, to look for hydrocarbons. Geologists can see what they previously had to try to imagine. In this way, 3-D seismic technology changed everything. Industrywide, it used to be that about one in ten wildcat wells would prove successful. The success rate using new technology is somewhere between one in six and one in eight.

After taking off from Lafayette, the first structure the Pennzoil team visited was a standard “jack-up” oil rig in the Ship Shoal 154 Field. (Jack-up rigs are floated out to sea with their legs towering into the sky; when they reach their destination, the legs are jacked down to stand on the seafloor.) The jack-up was operated for Pennzoil by the Noble Drilling Company, and like the majority of rigs now active in the Gulf, it stood on the continental shelf, in only 58 feet of water. The Ship Shoal 154 Field was a perfect example of the way in which 3-D seismic technology has provided new opportunities in old territories: The field was discovered in 1954, and Pennzoil acquired it from Chevron in 1992. It was part of a package that Chevron had designated its B portfolio and wanted to sell. Among the B properties, Ship Shoal 154 was assigned a rank of 256 out of 256—dead last.

The Ship Shoal property consists of a salt dome with reservoirs of hydrocarbons sitting above the salt on the dome’s flanks. Existing wells in a circle around the dome had already produced an estimated 40 million barrels of oil, and Chevron deemed the property nearly exhausted, but when Pennzoil geologists Clark Sutley and Tom Medary and reservoir engineer Susan Logan looked at 3-D seismic data of the area, they thought they saw some things that Chevron had missed. “If Chevron knew then what we know now, they wouldn’t have traded this,” said Medary. “You’ve got an old field capable of making somebody lots of money.”

Medary showed me the prospect that the jack-up rig was exploring on a pair of computer screens in his office in Houston. He called up a cube of data he had created after studying the seismic survey for about six months. Running through the center of the cube were images of two faults in the earth, which might allow hydrocarbons to migrate upward. Where the two faults intersected, there was a horizontal feature like a flying carpet, colored blue, with yellow and red bursts of color on it. This was one of five pay zones that Medary hoped the Noble crew might find: The blue part represented sand, or a potential reservoir, and the red and the yellow patches represented “bright spots,” or places where the seismic data suggested that there might be hydrocarbons. To get to the target, the Noble crew was drilling a complicated sidetrack out from an existing well that not only became increasingly horizontal as it progressed but also turned to one side. “It’s a highly deviated well, and it’s deep,” said Medary. “There’s a risk we won’t get down there.”

Pennzoil, like many of its competitors, has been battling to stay in the black. To make a profit, the company’s management is counting on augmenting production in its Gulf of Mexico fields. By last November, Medary’s team had already drilled four consecutive successful wells in the Ship Shoal field. When Pennzoil acquired the property, the field was making a meager 100 barrels of oil a day, but the additional wells had boosted production to 3,700 barrels and 15 million cubic feet of gas. Several weeks later, when I called for an update, Medary reported that the jack-up had completed the sidetrack and tests showed the well was expected to flow about 670 barrels of oil a day. That wasn’t as much oil as he had hoped for—only two of the five sand traps he had identified had contained economically viable amounts of hydrocarbons—but the team had successfully drilled two more new wells, and as a result, Pennzoil expected to increase total production from the Ship Shoal field to 5,080 barrels of oil and 20 million cubic feet of gas a day. “Management is pretty pumped about that,” said Medary.

If that’s all Pennzoil were to find in Ship Shoal 154, it would be enough to make the acquisition worthwhile, but the team working on the field was particularly gleeful about having gotten the property from Chevron because of another possibility altogether. It is highly speculative, and they don’t know yet if they are right, but their interpretation of the field seemed to show glimmers of a sand structure that could hold oil where earlier interpretations had shown only salt. Medary and the others realized that the salt dome might not be a true dome—they decided it was shaped more like a duck’s head. “It’s overhung,” said Medary. “There’s a section underneath this that has never been tested. That’s pretty exciting: It could be as big as what has already been produced above. Maybe fifty million barrels. Half a billion dollars.” In other words, Chevron’s least-favorite property might turn out to contain a spectacular subsalt prospect. For the next year or so, a newly formed Pennzoil team that specializes in subsalt plays will evaluate the possibility. If its research confirms what Medary’s team suspects, then an exploratory well might be drilled in 1997. Medary, Sutley, and Logan will know if they were right in about a year and a half.

The idea that oil might be found underneath salt was first considered in the seventies, when it became clear to geologists that their understanding of the Gulf of Mexico’s history had been too static. They had failed to perceive that the order of things had been disturbed. Almost all oil is formed from marine animals, which are full of lipids, or fats; when the Gulf first formed as an inland sea, about 190 million years ago, the basin teemed with aquatic life, making it effectively a big pot full of the ingredients required by the recipe for oil. Oil was generated after biological material accumulated on the floor and was buried deep enough to be cooked to high temperatures caused by the pressure of layers of sediment overhead and also by heat from the furnace at the center of the earth. For the supply to be recovered later, however, it had to migrate upward into cooler regions and become trapped in porous pockets of sand. “The Mississippi River has been the most important river, geologically, that we know of,” said Jim Fox, the geologist at Phillips Petroleum in charge of subsalt exploration. “As ice ages came and went, glaciers covered North America and then melted, and everything that those glaciers ate up went into the Mississippi River. Where does the Mississippi River empty into? The Gulf of Mexico. That’s what holds all of the oil and gas in this basin—these very young sands that have been eroded off of North America during glacial episodes.”

If you bored through the floor of the Gulf today in a spot undisturbed by later events, you would find recently eroded sediment on top, then Cretaceous Period rocks from which the region’s oil is probably generated, and then a thick layer of earlier, Jurassic Period salt, from a time when the inland sea completely evaporated. Geologists used to assume that the layers had remained in that order, which would mean that by the time you hit salt, you were finished looking for oil. They knew, however, that the salt layer was elastic and had played a crucial role in the migration of oil. “Salt is less dense than sediment, so sometimes salt will start to rise up, and that creates the conduits to move fluids,” said Mahlon “Chuck” Kennicutt II, a geochemist at Texas A&M.

What geologists did not understand until recently was that salt had sometimes moved up over oil fields, trapping oil below. The first indication that this might have occurred came in the seventies, when academic researchers found young sands underneath older salt at a puzzling formation called the Sigsbee Escarpment, which is in the deep water of the Gulf. They eventually realized that the opportunity for the salt to move had been created when North America twisted apart from South America about 170 million years ago, making a gulf out of the inland sea. As the Mississippi then dumped large volumes of sediment in from one direction, there was room for the salt layer to move forward, from the shore toward the mouth of the Gulf. “It’s like a rolling-pin effect,” said Fox. “You’ve got all this dough sitting out there, which is the salt, and you have this rolling pin, which is the sediment that’s being dumped in. This rolling pin is just rolling the stuff out in front of it.”

Once geologists began to piece together the way in which salt had moved, oil companies started racing to drill below it. Gulf Oil was an early pioneer of the concept but abandoned its efforts after merging with Chevron; Exxon made the first big subsalt discovery at a site called Mickey but opted not to develop the field because Mickey is located in 4,352 feet of water, making it a difficult and prohibitively expensive project. Phillips Petroleum, which is based in Bartlesville, Oklahoma, began pursuing a subsalt play in the eighties, after shooting its first 3-D seismic survey of properties it owned off the coast of Louisiana. When Phillips geologists noticed that salt had moved forward over younger sands there too, they decided to hunt systematically for places where salt sheets might be obscuring huge reservoirs. A study of the distribution of oil and gas fields in the region offered a tantalizing possibility. “There ought to be oil and gas fields basinwide,” said Fox, “but instead there were windows in production—areas where there were no oil or gas fields. We said, ‘Wait a minute. We know salt has been laterally displaced to the north and south. What if this whole area is covered by big salt sheets?’”

That is what Phillips eventually found to be true. Mahogany—the first subsalt discovery of commercial significance—is located exactly where the regional survey showed the biggest gap in production. But in 1989, when Phillips decided to buy property at that location, the idea was still tremendously speculative. “Now everybody is talking about how subsalt is a great opportunity, but they are still risky wells,” said Tim Wallace, the manager of Phillips’ domestic offshore exploration efforts. “Historically, any wildcat effort is a one-in-five proposition, or one in ten. A lot of things have to go right to trap economical amounts of hydrocarbons.” The risk was further compounded by the fact that salt acts like a veil or a curtain, obscuring what lies below; because sound travels through salt twice as fast as through rock, the salt layer causes distortions in seismic images of anything underneath. “If you put a pencil in a glass of water, the image of the pencil under the water seems to bend,” said Kay Wyatt, a geophysicist at Phillips. “That’s refraction. That bending is exactly what happens to sound waves when they go from sediments into salt and then back out again. You get two very strongly distorting boundaries.”

Scientists knew it was possible to correct the distortion by a mathematical process called depth migration, but computers powerful enough to process the enormous amount of data involved didn’t exist at the time. Phillips decided to forge ahead anyway, on the hunch that its theory was right and the anticipation that technology would evolve to provide detailed seismic imagery. “At the time, we were able to say, here’s what depth migration ought to show,” said Fox. “Most management teams weren’t willing to invest lots of money in somebody’s pipe dream.” Phillips started buying acreage in 1989, just as others were leaving the Gulf. The company picked up fifteen leases for prices ranging from $380,000 to $520,000. Today the same properties would probably go for more than $10 million each; one lease in the area recently sold for $40 million. All fifteen purchases were named for different kinds of wood; one was named Mahogany.

Now the clock was ticking: Under federal law governing drilling in shallow water, Phillips had only five years to find oil; otherwise its leases to drill on the properties would expire. Working on a Cray supercomputer, Kay Wyatt’s seismic-imaging team managed to perform an early type of depth migration, and Mahogany became the first of the fifteen prospects to be drilled when Phillips decided it looked more exciting and easier than the other locations. Drilling was clearly going to be expensive; Dorse Walton, the team’s drilling engineer, had been studying well logs of other companies’ experiences in and below salt, and he predicted that the Mahogany prospect would cost about $10 million to explore (it ended up costing $12 million). That was a lot of money to spend on one well—twice what the well would have cost if it hadn’t gone through salt—but as Phillips would learn, the company got off easy that time. Subsequent wells showed that drilling through salt often causes difficulties that run the total tab up to $20 million.

Phillips decided to share the risk with partners and signed a deal to split Mahogany’s costs and profits with Anadarko Petroleum and Amoco early in 1993. To work on the project, the partners hired a crew from the Diamond Offshore drilling company. Mahogany sits right on the edge of the continental shelf, in 370 feet of water, so Diamond Offshore brought in a semi-submersible rig. Although it is held in place by ten anchors when drilling is going on, the rig can maneuver like a boat and was brought across the Atlantic from the North Sea for the job. Diamond Offshore began drilling a wildcat well at Mahogany in the spring of 1993. “The first well was really exciting because we didn’t know what to expect all the way down,” said Wallace. “In general the salt drilled a little bit faster than we expected. The problem was right below the salt. It’s a high-pressure area and the salt acts like a seal and that causes different geology right below.” Just under salt, the crews found an interval of unstable rock, trapped under great pressure, and the well constantly threatened to collapse on itself. “We spent a couple of months in that zone,” said Wallace.

Amazingly, the seismic-imaging team had predicted nearly to the foot where the salt layer would end. Now they would learn if they had been able to see below the salt layer with any accuracy. That September, the drilling crew found a huge oil field only one hundred feet from where the seismic team had said it would lie—an effective bull’s-eye. “You pat yourself on the back and say, ‘My god, I can’t believe I guessed right,’” said Holly Harrison, a geologist who worked on the find. Last April, Phillips announced that the field was commercially viable and would be developed. Wallace declined to estimate the amount of oil in the Mahogany find, but sources at Phillips said they think they’ll get 100 million barrels from the field. Production is supposed to start late this year. After Mahogany, Phillips began drilling below salt at other prospects, and the possibility of finding huge new reserves in shallow water—where all the big fields were supposed to have been discovered years ago—has caused a rush of lease purchases and drilling. This past November, the second commercially viable subsalt discovery, called Enchilada, was announced by Shell and its partners, Pennzoil and Amerada Hess.

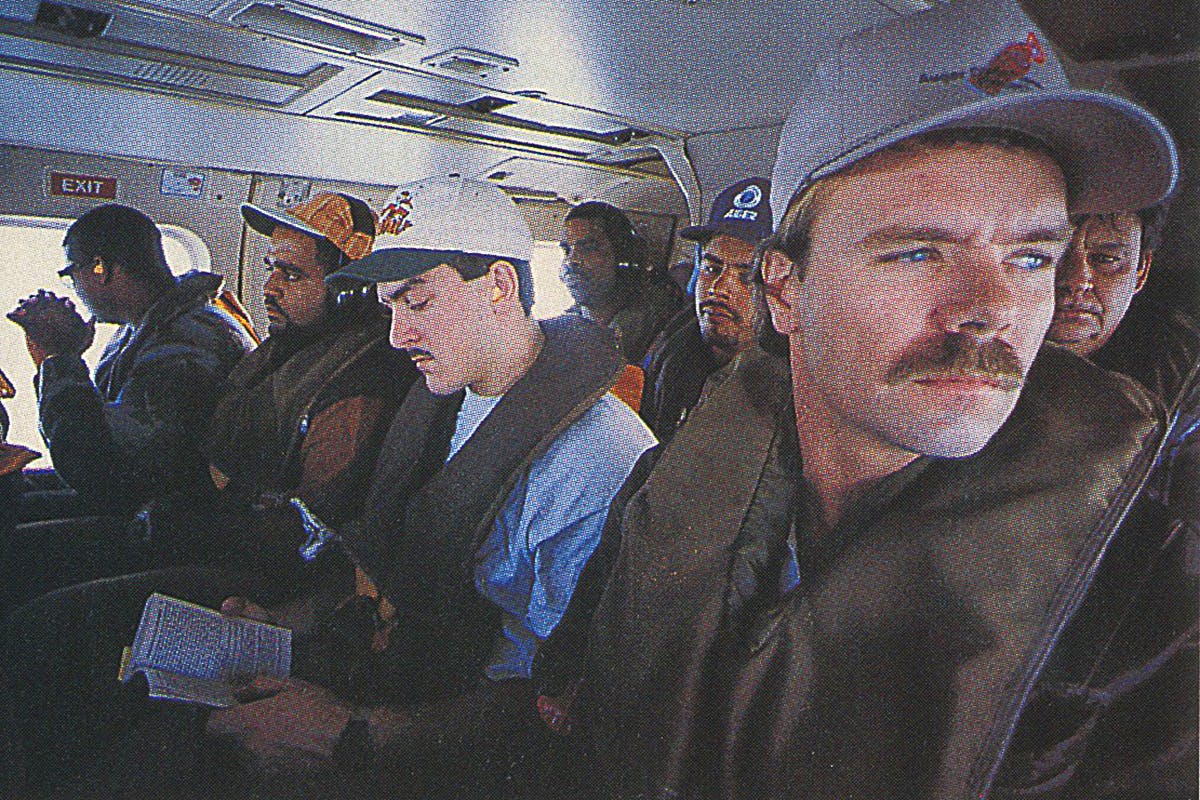

In 1994, after decades of research and exploration, Shell Oil (the domestic arm of the multinational Royal Dutch Shell) began pumping oil up to the deepest offshore oil-producing platform in the world, called Auger. The platform sits in the Gulf of Mexico in 2,860 feet of water. Typical structures on the shelf stand above the water on fixed legs, but Auger floats like a ship; it is tethered to the distant seafloor by twelve steel pipes and kept in place by eight mooring cables that fan out in different directions. The platform is located in the Garden Banks area, 137 miles from shore, and crew members, who serve fourteen-day shifts, are ferried there in helicopters that depart from Morgan City, Louisiana. On the morning I went out, many of the crew members waiting to depart had driven all night to get there: The oil field draws men from all parts of Mississippi, Alabama, Arkansas, Louisiana, and Texas. They were entirely nonchalant about the strange commute. Ten minutes into the helicopter ride, I looked up from the mesmerizing pattern of marshland and estuary below and saw that the cabinful of men had their heads bowed, as if we were in church. Every one of them had fallen asleep.

About an hour and a half later, past the clusters of rigs up on the shelf and after a long expanse of empty ocean, we arrived at the Auger platform. From the air, it looked like a Erector Set contraption, but when we set down, it became clear that Auger is a state-of-the-art, deluxe (there are elevators) marvel of engineering. The platform is the size of two football fields, and I could feel it swaying back and forth. “We’re like a cork in the water,” said Mike Woodward, Auger’s production supervisor, who lives in La Grange. To accommodate the motion, the eight wells then flowing were attached to the platform by flexible joints that move like the body of an accordion.

Auger’s operations are overseen from a control room lined with banks of computer screens. The person in charge of production and incoming helicopter traffic sits in a chair known as the hot seat, in the center of the room, in front of a semicircular array of computers. Additional staff monitor the surrounding waters with radar—Auger sits twelve miles south of the major shipping lanes to Mexico and the Caribbean, and sometimes the vessels need to be reminded to keep to their course. “They drive all over the place out here,” said John Blackwelder, Auger’s control room operator. In an office nearby, marine technicians employed by Oceaneering International who are under contract to Shell perform underwater maintenance with a remote-operated vehicle—human beings cannot survive at the depth Auger is anchored. The vehicle looks like a submersible golf cart with mechanical arms, and the engineers maneuver it from their office with joysticks while watching the television screens above their consoles, which show murky underwater scenes captured by cameras attached to the vehicle. Every once in a while, some peculiar deep-sea creature will wander in front of the vehicle’s headlights. Dave Housteau, a technician who was on duty when we visited, played a videotape of the year’s highlights, and we watched, increasingly awestruck, as a parade of strange forms drifted by: a giant, shimmering, translucent jellyfish; a shark circling in lazy figure eights; a squid that looked like a flying chiffon outfit.

All the floating technology is, of course, expensive. The tab for the Auger platform came to $1.2 billion. After building it, Shell decided to embark on additional deep-water projects; all told, the company plans to spend about $5.3 billion to develop seven different prospects in deep water (that figure doesn’t even include the amount spent on exploration or leases). Together with additional investments in shallow water, those expenditures represent the vast bulk of Shell Oil’s exploration and development ventures. In other words, the domestic arm of Royal Dutch Shell has staked its future on the Gulf.

Shell began investing in deep water more than a decade ago, when it stunned competitors by snapping up the majority of deep-water leases sold in 1983 and 1984. No other company bet as heavily on the play at that time because nobody was certain oil had been generated in that part of the Gulf in significant quantities or that there were reservoir sands out that far to trap the oil. Even if both oil and sand existed in deep water, nobody was certain that it was technologically possible to produce oil from the area, or economically feasible to try. But if the deeper regions of the Gulf were rewarding, then Shell wanted to be there first. “You make the most profit by getting in early and exploiting a new concept before anyone else thinks to do so,” said Don Haefner, a geophysicist who worked on the Auger project.

Shell had been studying deep-water territory around the world for several decades, and by means of an exploratory drilling program called Eureka, which took place in the sixties, it had learned that oil was indeed being generated in the deeper parts of the Gulf and was seeping up through vents in the ocean floor—the company didn’t know what quantities of oil might have been generated, but it was confident there was a “charge.” It took longer to figure out whether sand traps existed that far from shore. Sediments on the shelf are typically laid down directly by the Mississippi and are therefore called deltaic deposits. To many geologists, it didn’t seem likely that the river would carry significant amounts of sand out into deep water. They didn’t know that other agents—underwater rivers known as turbidity currents—were transporting sand that far. Turbidity currents are rolling forces that form when sediment becomes suspended in water. They were first discovered after an underwater earthquake struck off the coast of Newfoundland in 1929; over the next thirteen hours, some force snapped five transatlantic telephone cables, traveling more than three hundred miles to do so. In the Gulf such currents have carried long trains of sand and mud from the continental shelf out into the abyss beyond. When a sand-laden current runs into some obstacle, it doubles back on itself, spilling caches of sand that can serve as reservoirs to trap oil.

In the early eighties, armed with a rudimentary understanding of turbidity currents and oil seeps, Shell decided to invest in deep-water properties to see what they would yield. One of its early finds was the huge Bullwinkle Field, in 1,353 feet of water. Fortified by that triumph, the company decided to find out whether it would be profitable to venture even farther out. “Shell bought about ten prospects that were considered very speculative,” said Mike Forrest, who was in charge of the company’s offshore exploration in the eighties and now works for Maxus Energy. “They were in water depths ranging from one thousand feet to four thousand feet, so it was a big step out. We named all the prospects for different kinds of tools, and one of them consisted of two blocks that we called Auger. At the time, we didn’t recognize what it was.”

Because it was operating in deep water, where it is more difficult to explore, the company had ten years to find oil before the properties would revert to the federal government. To figure out where to drill, the offshore division shot a two-dimensional seismic survey from boats owned by Shell. The research was considered so confidential that some employees were not allowed to tell their own supervisors what they were doing—they reported directly to the division manager—to minimize the possibility of leaks. Teams of geologists and geophysicists pored over the surveys. “Out of the ten prospects, Auger rose to the top of the list,” says Forrest. “But part of the structure that looked really good was in two other blocks that we didn’t own yet. We were so afraid that other companies would go after the blocks in the next lease sale that we bid $5 million on one and $2 million on the other. It turned out we didn’t have any competition at all.”

Mike Dunn, the geophysicist who analyzed the seismic data, told his superiors that there were several interesting images in the Auger Field. “He told us about two promising pay sands at twelve thousand feet,” recalled Forrest. “Then he said, ‘We also have a riskier prospect at about eighteen thousand feet that we ought to at least talk about.’” Forrest, who had a reputation for taking calculated chances, decided to go for all of the possibilities and planned a deep well. Drilling began in 1987—right after the price of oil had plummeted. Now the Shell team was under tremendous pressure; any discoveries would have to be huge to justify the cost of building a deep-water production platform. The top two targets, which had looked so tempting, turned out to be gas fields. The reservoirs were large, but because they held gas, they probably wouldn’t justify building a production platform. It began to look like the prospect might not be economically viable. A sidetrack to test the deeper prospect began in late July. Within a couple of weeks, the drilling crew hit a third sand trap and found oil—but only in modest quantities. Finally, that September, at about 19,200 feet below sea level, they hit something else. It was oil, and it was mammoth.

The team’s elation lasted a few weeks and then there was bad news. Word came back from the lab: Core samples from the rig showed that the oil was “sour.” Up on the continental shelf, nearly all the major finds had consisted of “sweet oil,” which is low in sulfur and therefore sells for a premium. But as Shell was in the process of discovering, most of the oil farther out in the Gulf is full of sulfur, which has to be separated out at the refinery. Shell would have to discount the price, making its giant field worth perhaps 20 percent less than a comparable find of sweet oil. Operating as close to the profit margin as the company was, this posed a significant problem. Again, the team wondered if the site would pay off.

The key to the decision to go ahead came from the company’s experiences at Bullwinkle. There, Shell geologists were discovering that sands deposited by turbidity currents behave in an entirely different fashion than the deltaic sands found in shelf reservoirs. “That’s where we first got the confidence that these turbidites would produce at the kind of rates that we needed in deep water,” said Jim Funk, a general manager at Shell. “We’ve got a couple of wells at Bullwinkle that did eight thousand barrels a day.” Rates that high were practically unheard of in the region—a really good well on the shelf might produce two thousand barrels a day. Deep-water sands are unusually prolific because turbidity currents dump such immense quantities of sand in one place that the reservoirs tend to be far bigger than shelf reservoirs, meaning they hold more oil in the first place. In addition, deep-water sands tend to be less faulted—up on the shelf, pockets of sand shift and move around as the Mississippi continues to lay down sediment overhead, often causing a single pocket of oil to break into smaller compartments. Deep-water sands are also unusually porous, because as turbidity currents travel long distances, they cause a sifting process that results in clean sands and allows oil to flow through them faster. Finally, deep-water sands are often geopressured because the oil is tightly sealed below layers of dense mud. This prevents the liquid from moving up to balance the weight of the earth above, leaving it trapped under high pressure. “It’s like putting a brick on a balloon full of water,” says Alan Kornacki, an exploration geologist at Shell. “The water wants to burst upward. If you put a straw into that balloon, the weight of the brick will push the water out at a tremendous rate.”

Betting that Auger, like Bullwinkle, would flow at unusually high volumes, Shell decided to develop the field. The floating platform took four years to construct. Because there was no existing infrastructure that far out in the Gulf to pipe oil to shore, Shell laid down 72 miles of new pipeline to an existing production facility. Auger began operations in April 1994, and by that August, the platform had reached full capacity with only eight wells flowing. One of the wells has been producing as much as 13,000 barrels of oil a day, which is a record for the Gulf of Mexico (Auger’s well is producing 4,000 barrels more than the previous record). Shell had bet right—in fact, the company had underestimated the rate at which the field would flow. The Auger platform was designed to handle 42,000 barrels of oil a day, but was soon handling 60,000; recent expansions have boosted production to as much as 69,000 barrels, but even that isn’t enough to handle all the oil the wells are capable of generating. Geologists at rival companies suggest that Shell goofed, because it could be making even more money if it had built a platform with greater capacity, but Shell’s management responds that this is the kind of problem it likes to have.

After discovering Auger, Shell pursued its other deep-water projects with a new vehemence. In 1989 the company began drilling a prospect called Mars and stumbled onto a field twice as large as the Auger discovery. Production at Mars is scheduled to begin later this year. News of the Auger discovery, which was made public in 1989, electrified the industry—suddenly everybody knew deep water was viable. Since then, giants like British Petroleum, Exxon, and Mobil have stampeded to obtain leases in the region; more than 195 wildcat wells have been drilled in deep water to date, and 33 discoveries have been announced. “What Shell has done out there is truly extraordinary,” said John Kingston, the editor in chief of Platt’s Oilgram News, the preeminent industry publication. “They basically opened up a new vista.”

All of the activity in the Gulf of Mexico today has helped introduce a certain vigor into the Texas economy. Most of the new drilling is being done in federal waters, and Texas gets no royalties from the oil produced there, but the scramble for more reserves nevertheless has an effect on the state. Although many companies that supply services directly to oil rigs are located in small towns along the coast of Louisiana, most of the oil companies themselves have their headquarters in Houston, and that has attracted a panoply of additional white-collar and blue-collar service jobs to Texas too. “There are geophysical companies, exploration crews, drilling companies, and all the firms that supply seismographic data,” said Gerald Higgins, an oil expert with the state comptroller’s office. “There are aircraft companies that lease the helicopters that fly back and forth to the rigs. The operation and maintenance of the semi-submersible rigs is really a Gulf industry, and Texas gets a pretty good bite out of that.”

Profits for the companies that provide services to the oil industry swelled last year; in the second quarter, combined profits for eight firms tracked by the Wall Street Journal were $362 million, 62 percent higher than in the same period the year before. In the third quarter, profits were up again, though only by 6 percent. “Part of that has been that there’s been more work overseas lately, but the other part has been the work in the Gulf,” said Bill Gilmer, who researches the energy industry for the Federal Reserve Bank in Houston. Of course as the region gets busier, the risk of oil spills and other environmental hazards increases too. (Every year, billions of gallons of water containing heavy metals and toxic organic compounds are dumped into the Gulf from production platforms, and so are millions of barrels of mud and cuttings from well holes that contain lead, mercury, and arsenic, which kill organisms living on the seafloor.) And more damage is done to the fragile wetlands that border the Gulf. “You’ve got jobs, but the more activity you have, the more the coastline erodes,” said Bill Nevitt, a stockbroker who is active in the Sierra Club in Louisiana. “Then you have to spend more money to rebuild it. So you’ve got a push-pull situation.”

Finally, while a “managed boom” does generate profits, it does not generate that many new jobs. Oil-service companies have been hiring to keep up with the demand for their services, but the overall number of people employed by the oil industry continues to decline. After wells are completed, permanent production platforms are built to produce the oil, and that is where the majority of jobs in the Gulf of Mexico are. Twenty-four people operate the four manned platforms that Pennzoil owns in Eugene Island, and ten of them worked on the C platform, where I spent the night. One of the most common jobs is that of lease operator, someone who tends the machinery that siphons oil and gas out from under the ocean floor. When we visited, the men were joking with a black sense of humor about the skeleton nature of the crew left to man the platform. They had enough people when everything was going all right, but they didn’t like to think about what might happen if an emergency occurred. That is the story of the Gulf of Mexico today: Companies are finding more oil with fewer people. Yesterday’s boom was a miraculous time, when it seemed as though oil could magically transform the fortunes of everyone in the business. Today oil is an industry like any other—preoccupied with downsizing and the bottom line—and even the good times are hard.