This story is from Texas Monthly’s archives. We have left the text as it was originally published to maintain a clear historical record. Read more here about our archive digitization project.

In May of this year Woody Dinstel sat down at his desk in Houston to write a letter. First he looked at the watch. It was a gold Hamilton Masterpiece, slim and heavy. On the back was engraved WOODY DINSTEL UPON RETIREMENT FEBRUARY 1, 1978, EXXON.

He was writing to Dr. Tom Barrow, senior vice president of Exxon Corporation in New York, the highest-ranking geologist in the company and a hero to the older generation of explorationists, an emblem of the best in the company. Dinstel had once made a presentation to Barrow in England and had been very impressed; he thought perhaps Barrow might remember him.

The letter was an appeal for help, for Dinstel was having some serious problems with the company. It had been his plan to take early retirement from Exxon—to receive a pension of $611.13 a month and perhaps in a few years to move to the country house he and his wife owned in Mississippi. For a while, it had appeared that there would be no problem with that. Dinstel had signed all the requisite papers, had had his farewell lunch at a fancy restaurant in Houston, and had received the gold watch. But at the last minute the company had changed its mind, perhaps because it had learned that Dinstel was planning to take another job at higher pay with a smaller oil company, and called the whole thing off. Either stay on or quit with no early retirement benefits, Exxon had told him. “My best recourse,” Dinstel wrote Barrow, “is to contact someone I know as high up in the corporation as possible. Perhaps that executive will react by thinking, ‘This guy had 23 years with the company; did we give him the shaft?’” Dinstel told Barrow his story, and ended his letter this way:

“I deserve to be an annuitant; it is my right; I have earned it.

“I used to love Exxon.

“Your consideration of my situation will be appreciated.”

Barrow never wrote back. Woody Dinstel, who was so loyal to Exxon that he drove around with the company’s marketing symbol, a plastic tiger tail, attached to the gas cap of his car, had lost his loyalty and was going elsewhere, so the company’s loyalty to him was at an end.

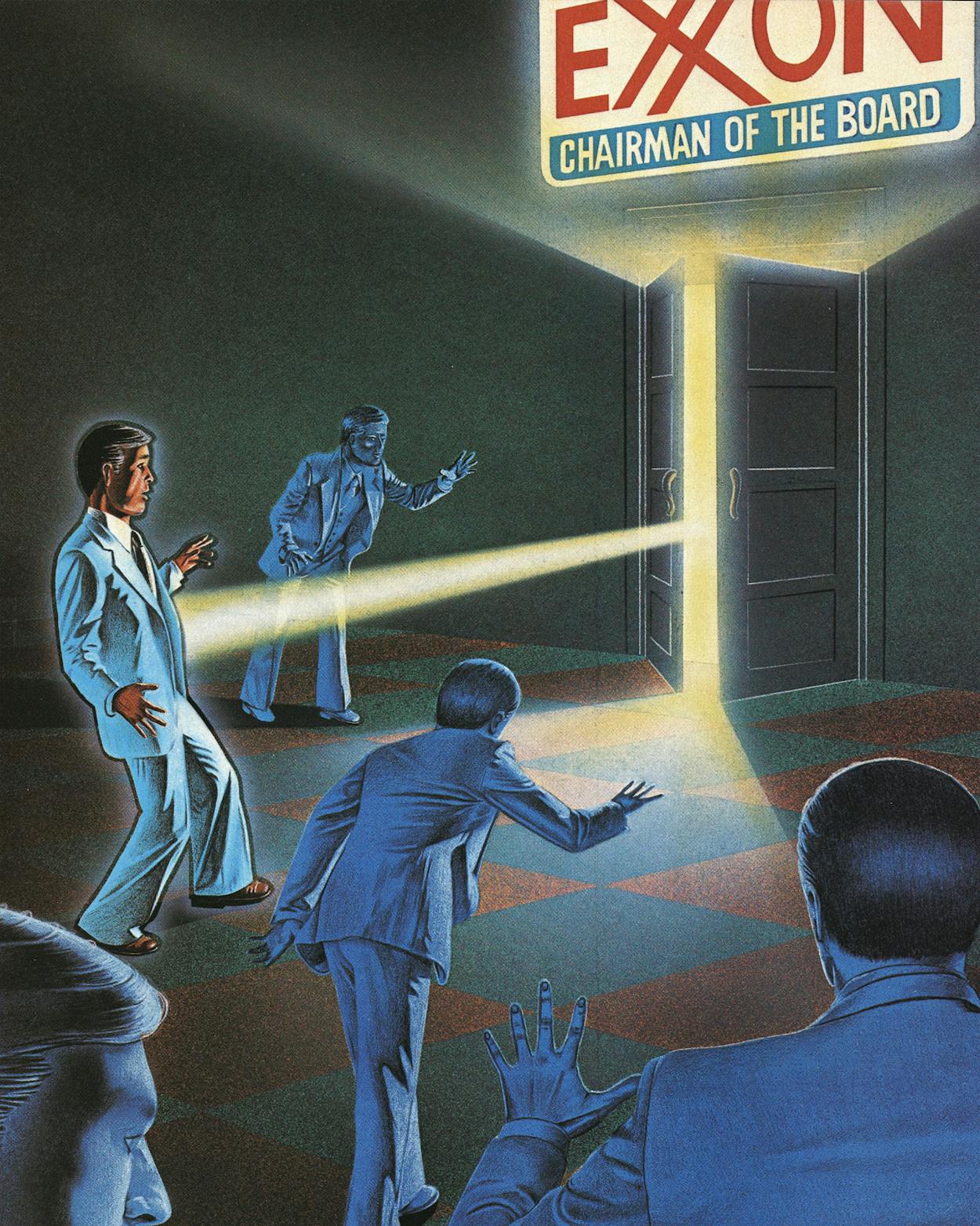

This is a story about success and failure in the world’s largest industrial corporation, and about loyalty and love too. It’s a Texas story, and not just because Exxon’s domestic operations are headquartered here or because 15,000 Texans work for Exxon. This is a state that has drawn much of its sense of itself through success stories—the taming of the land, the discovery of oil and gas, the growth of businesses, the building of cities, even the victories of football teams. One of the classic success stories is that of the founding of Humble Oil & Refining Company in the oil fields of the Gulf Coast by a roughneck, a shopkeeper, a banker, and six other men, who ventured into a new area, took some risks, and built the state’s biggest oil company. These men rose through strong individual, entrepreneurial achievement. They broke new ground and, through determination and talent and effort and luck, built something that hadn’t been there before.

Now Humble is Exxon USA, the largest subsidiary of Exxon Corporation, headquartered in a Houston skyscraper, a symbol of how success in Texas is changing—and with it, our identity. The men who run Exxon are not entrepreneurs; they are managers. Success or failure in Texas is no longer linked to venture and risk. Increasingly, it means rising or not rising through the ranks of a large, established organization. That will mean that different kinds of people will rise, on the strength of different skills. And it will mean that those who do succeed will draw their sense of pride and self not from what they have built so much as from how they have risen in the organizations that selected them and shaped them to lead. That’s why, in a corporation with 128,000 employees, loyalty and love are operative concepts, strongly felt by those who have succeeded, painfully absent for those who have not, like Woody Dinstel.

And it’s why top executives of Exxon, by and large a tough, calm, competent breed, wander into emotionalism when they talk about how they feel about the company. Back in the days when Exxon was Standard Oil Company (New Jersey), its chairman, Monroe J. Rathbone, told a reporter from Fortune, “Working for Jersey has been a great thing for me. I’ve never in all these years been disappointed in this company. It’s been an exhilarating experience.” Ten years later, Clifton C. Garvin, Jr., Exxon’s present chairman, asked by Forbes how he felt about being in charge, said, “I think of it as a proprietary relationship. Like running a company of which I am the owner. It is just my duty, but my deep personal desire is to keep it in the best shape possible for the men who will come after me.” When Garvin was named chairman in 1975 and Howard C. Kauffmann president, Monroe Rathbone wrote them a note. “Your job right now,” he said, “is to develop some more Garvins and Kauffmanns.”

These are company men who obviously feel strongly about the organization and about the importance of developing more company men to run it in the future. The reason the feelings are so strong (try to imagine a government bureaucrat saying those things) is that what Garvin said about a proprietary relationship is, in a way, true. Certainly the people who run Exxon are in name managers, not owners, but the nominal distinction obscures the true nature of most large corporations. The owners of Exxon are diffuse and almost invisible. The board of directors is made up mostly of men who may not be founders, but who have been with the company for thirty years or more, since they were 22 or 23, rising up from the oil fields and refineries. The six senior men on the board own close to $8 million in Exxon stock and are paid salaries ranging downward from Garvin’s $485,592 (with benefits, $729, 267). They run a company with operations in more than a hundred countries and gross revenues larger than the annual GNP of Mexico or Australia. No wonder they feel proprietary.

Of course, most bureaucracies in the United States are staffed by a career service; the best-known examples are the civil service and the military. But in those a person can rise only so high through the ranks, and the policy decisions are made by outsiders, appointed secretaries of Defense or State. The job of the career service is to see that these policies are carried out. Exxon, however, is a self-contained world, where the career service provides everything. It doesn’t hire hot young vice presidents away from Union Carbide. It doesn’t bring smooth investment bankers to run the show. Until 1966 the company’s board was made up entirely of employees (now they hold eight of seventeen seats on it). Other companies farm out much of their legal work to law firms; Exxon, for the most part, relies on its in-house legal department. Other companies, when they want to raise money through a bond sale, let an investment house arrange it; two years ago, Exxon shocked the financial world by underwriting and distributing a $54.9 million bond issue itself, via a rare procedure known as a “Dutch auction.” Other companies have career systems of varying sorts, but Exxon’s (along, perhaps, with AT&T’s) is known as the most carefully run and the best at providing talent and continuity.

One result of the career system is that, while there are no old-fashioned, overnight wildcatter success stories at Exxon, rises from rags to riches almost as dramatic as in the old days are still possible. The company is run by engineers and geologists, most of them from small towns and state universities—men who couldn’t be more different from the leaders of the oil business of two generations ago, but who share with their predecessors enough drive and hunger to have done what is necessary to get to the top. Most people think the positions of greatest responsibility in the dominant institutions in this country are held by members of a loosely knit establishment made up of people from privileged backgrounds who know and tend to help one another. At Exxon, that notion just doesn’t apply.

For that reason, the personnel system is of paramount importance to the company, the key to its continued health. In effect, it is the company’s reproductive system too, doing for Exxon what pistils and stamens do for flowers. Exxon has to be absolutely sure that within the last five years it has hired someone right out of school with the talent to assume the chairmanship one day and do well at it. In part that’s a matter of faith, but there are good reasons why the faith in the personnel system is so strong. The system is meticulously planned and operated and absorbs considerable amounts of time and effort and money. One company publication recently said Exxon spends $203,000 on each employee every year. The company carefully recruits and trains and rates people. Those who, for reasons of ability and temperament, aren’t suited to a high position in a major corporation stay in the middle ranks, and those who do rise are the ones who have shown themselves to be so suited. Those tough, calm, competent men in the boardroom weren’t just born that way. They were shaped.

The personnel system deserves much of the credit for Exxon’s continuing vitality. For more than a century, since the days of John D. Rockefeller’s Standard Oil Trust, Exxon has probably been the most significant and successful corporation in the world. “In the history of U.S. business,” Dun’s Review wrote five years ago, “the company’s success has been truly singular. Of the huge industrial companies that were begun before 1900, only Exxon survives with anything like its original preeminence.” Over that time, Exxon has also probably been the most hated company in the world, and the personnel system is partly to blame for that too. Exxon is a closed society, unfriendly to outsiders—an organization good at the oil business and bad at explaining itself to the public.

Exxon would not cooperate with this story. When I was beginning my research, I went to the Exxon USA public relations office in Houston and explained that I was interested in writing about the company’s personnel system. Exxon has a rule that none of its employees can talk to the press without first clearing it with public relations, and public relations won’t clear anything unless it has sized up the writer’s intentions and made a decision to cooperate. In this case they decided not to—not to let me do any interviews with Exxon employees, not to answer a list of factual questions I submitted, not even to comment on a draft of the story. For several weeks William Broyles, the editor of this magazine, and I discussed our case with various Exxon officials, but to no avail.

I found that the majority of former employees of Exxon, especially those who left happy, wouldn’t talk either. “A man who’s held the position I’ve held with Exxon,” explained Charles F. Jones, a former president of Humble Oil, “isn’t going to go against the wishes of the company.” A few former employees were willing to talk for the record, but most either wouldn’t say anything or asked first for solemn guarantees of their anonymity. “As long as you’re still in the oil business,” one man told me, “Exxon can put the big hurt on you.” Some people agreed to interviews and then got cold feet at the last minute and backed off. One man who had left Exxon spoke bitterly about the company for fifteen minutes on the phone, and I arranged to see him in person in Houston. But when I called him up on the appointed day, he didn’t want to meet after all, only to emphasize over the phone, “how well I love the company.”

Fear, the obvious answer, can only partly explain why the company and its employees were so reticent. The reasons for the company’s stubborn refusal to give its side of the story about a personnel system of which it is extremely proud are, I think, more complicated than that. The company’s explanation to us was that it didn’t consider Texas Monthly an “appropriate forum” for such an article, and, while my strong initial inclination was not to believe that, I later came to understand Exxon’s reasoning. I think it is probably very difficult for people who have spent their whole adulthood living the Exxon life to explain it to outsiders.

It’s generally agreed, among those who love the company and those who don’t, that the successful Exxon executive is a person (almost always a man) of a particular type. Above all, he is extremely able; the system is good at weeding out incompetents. Like many men who have risen in our large corporations, he comes from a stable, middle-class background, usually not a big city and usually not the East or West Coast. He’s a family man, happily married to an attractive woman and the father of several children. He and his wife take care to be active in respectable community affairs. He’s not an eccentric, a maverick, or an entrepreneurial type. He’s not a flashy or sloppy dresser. He’s bright, aggressive, good with numbers, less good with people. Very likely he is a veteran of the military. He’s willing to relocate frequently (though this is becoming less the case) and to work hard on any assignment he’s given. “The people who did best there,” says one former employee, “were those who kept plugging, who never questioned authority, who said, ‘If this is what the company wants, I’ll do it.’ Anyone who said, ‘Why the hell am I staying up all night Sunday to finish this when nobody needs it till Thursday?’ didn’t have the right spirit.”

The particular skills required of the successful Exxon manager are more those of the corporation than those of the oil field. It’s important to learn how to deliver an impressive presentation to management, how to write a good memo, and how, if you’ve got an unappreciative boss, to circulate carbons of your memos to his boss. It’s helpful to develop a knack for getting assigned to fast-rising supervisors, who can take you along with them, and to winning teams—it’s better to work in the North Sea, where Exxon is finding oil, than in Destin Anticline, where the company paid the federal government $316 million for leases and drilled seven dry holes. It’s bad to get too emotional, to become too attached to a project to be able to accept its rejection. Exxon is a company famous for doing everything by committee, so it is crucial to be able to operate that way. The top manager at Exxon is the model of the successful organization man, hardworking and committed but, above all, a member of the team.

Most of the time, Exxon finds him on a university campus. The company doesn’t make public any figures on what schools its people come from, but it is commonly felt around the placement offices at the University of Texas that UT provides more of Exxon’s professional employees than any other school; whether or not that is so, UT is a good case study in how Exxon recruits. With the exception of law students, people getting degrees at UT can make more money with an oil company than with any other employer, and Exxon is regarded as the best and the highest paying of the major oil companies.

Exxon, in turn, is looking for the best people, people in the top quarter or even tenth of their class, people who are active in some leadership-demonstrating activity outside the classroom, people who are steady and responsible—people who, as one student says, “embody the ideals of American business.” They must be technically trained in a field where Exxon needs experts, like geology, engineering, accounting, geophysics, or petroleum land management. Even among MBA’s Exxon prefers those who have a technical undergraduate major. Only Mobil, of the major oil companies, has a reputed interest in undergraduate liberal arts majors; last year UT’s arts division had a career symposium for its students, and Exxon declined to send a representative.

In some of the departments from which Exxon hires, virtually every student is headed for the oil companies, and the companies keep a fatherly eye on those departments. They contribute money and equipment to the engineering and geology departments through special foundations (called Industrial Associates and the Geology Foundation, respectively), which supplement the departments’ regular budgets from the university. Last year Exxon gave the geology department at UT a seismic truck. It’s hard to look at these practical and businesslike arrangements without feeling some twinge that college really ought to be for reading Shakespeare, but increasingly the liberal arts are viewed as a luxury. For those who are going to need jobs immediately after graduation, the pre-oil majors are perhaps the best guarantee of success.

Unlike the big Houston law firms, the oil companies don’t wine and dine students. Some of them hold informal sessions over beer and nachos, but Exxon doesn’t, and doesn’t have to. “They just crook their finger and everyone comes running,” says one geology student. During the spring and fall hiring seasons, Exxon dispatches teams of interviewers to UT to have half-hour talks with the dozens of students who sign up for them. Those who fare well may be asked to Houston, where they’ll have a day of interviews at headquarters and perhaps go out to dinner with a bright young manager. The company stays faithfully in touch with these people, calling and writing them occasionally until they’ve made a final decision about where to work. Also, says one placement officer, the recruiters sometimes take a friendly professor out to lunch and pull out a list of names over coffee, hoping to find out who’s really good.

The only reason a promising pre-oil student might turn down a job with Exxon would be to work for a smaller independent company. There, a very outstanding student might be offered more money, more responsibility, and the opportunity for quicker advancement. But Exxon is reliably well paying, secure, and an excellent training ground. A student getting an undergraduate degree in petroleum engineering could reasonably expect a job with Exxon to carry a starting salary of more than $20,000—in many cases, no doubt, more than the student’s parents make.

Once at Exxon, a young professional immediately comes under an intensive and complex system of evaluation. Once a year each manager in the company rates all the employees under him (anywhere from 25 to 70 people) on a one-to-five scale. One is for water-walkers, a 2.5 means you’re above average; and a 5 means termination, although, as one employee puts it, “you’d have to assassinate somebody to get a five.” There is a forced distribution system for the ratings, so that only a small percentage of the company’s employees can get ratings of one. Each manager also does what’s called a seriatim listing of the employees under him—a ranking, in numerical order, according to performance. And these numbers are reviewed by more than one supervisor. As a result, Exxon avoids some of the problems endemic to other bureaucratic personnel evaluation systems. In the Army, for instance, an officer’s career depends completely on the Officer Efficiency Report he gets from his supervisor, and these are only nominally checked by others. So, much more than Exxon employees, Army officers talk about there being an ironclad rule that, no matter what, you don’t piss off the boss. Another problem in the Army and many other bureaucracies is grade inflation: there’s no reason for a supervisor not to give out lots of very high ratings, thus rendering them nearly meaningless. But at Exxon, the forced distribution system prevents that.

Supervisors also fill out more detailed forms on employees, evaluating their performance and suggesting areas for improvement. And each employee fills out a form on himself, saying how he thinks he is doing and what his goals are. With those in hand, employee and supervisor meet face to face and discuss their findings. This is the only part of the whole evaluation process that many employees know about, and, depending on the boss, the performance review sessions may be a healthy exchange of views or completely pro forma. “Often my boss would tell me what he said on the form, and I’d just say yessir, yessir, yessir and sign it,” says one former employee.

The last and most important step in the process is a rating of potential that managers give their employees. At Exxon, as in the civil service, people move up through a series of numbered grades, with pay tied to the grade. A college graduate in a professional job will usually start as a 22. Above the numbers is a second series of lettered grades leading all the way to the top. So if you’re a 22 now but show a good deal of ability, your boss might list your potential as 29. If you get a 31 or 32 or are judged to have the potential to “go into the letters,” then you have a good chance of becoming a “hi-po,” a member of a special high-potential group.

Upper management in each department culls all the evaluation reports and picks out the employees who seem to have high potential. These people are divided into two groups—those with just plain high potential and those with extra-high potential, the ability to become a corporate officer one day. Of the 28,000 employees of Exxon USA, several hundred might be in the first of these groups and as few as 25 in the second. The hi-pos get a great deal of attention from management. At Exxon USA, each hi-po has a special four-year development plan, and his progress is regularly reviewed by a group whose members include the president of the company, Randall Meyer. Even at the pinnacle of Exxon Corporation in New York, the employee members of the board (who make up an “inside board” that meets more frequently than the regular board) spend much of their time talking about where to move particularly promising employees.

You are never told straight out that you are on this fast track, but you can tell. You get paid in the upper end of the scale for your grade. You get promoted rapidly. You switch jobs a lot. In the elevator, vice presidents whom you’ve never met greet you by name. For every significant job at Exxon there is a replacement list—a roster of possible replacements for the job’s present holder. Fast-track people, who tend to be on these lists, get the jobs when they open up. People are chosen for the fast track very young—often in their first five or six years with the company, almost never after age 35. That means their intelligence and ability are more important than their specific experience in winning them a rendezvous with destiny. Where management chooses to steer the fast-track people shows what experience it thinks its top executives need to have, and, by extension, what it considers most important to the continued prosperity of the company.

A typical fast-track career might go like this: after graduation with a BS and an MBA, your first job would be with Exxon USA, somewhere in the field—either at a district office near drilling sites or at a refinery. Exxon has myriad divisions and specialties, but, in broad outline, the most important kinds of work are exploration and production (“upstream”), and transportation, refining, and marketing (“downstream”). Of these, the most reliable producers of top executives—and, therefore, in the company’s mind, evidently its most important functions—are production and refining. Of Exxon’s many companies, the main supplier of talent for the corporation is Exxon USA. It is the work of drilling for and refining oil and gas that is at the center of what Exxon does (more so, interestingly, than finding the oil), so that’s what the company rewards. More than anything else, it is in the business of efficiently processing vast quantities of its product.

After the initial field job might come a tour back at headquarters in a staff job, doing financial analysis and planning. Field jobs are the meat and potatoes of the company, and it is important to show that you can meet a production schedule, stay within a budget, and meet deadlines. But when any organization becomes large, staff work is also crucial, and a staff job provides the opportunity to learn the skills of the office, to meet executives, to make presentations to important people, to make yourself well known. Following the first headquarters job might be a second tour in the field, this time in a supervisory capacity. All during this time, in addition to doing your work, you will attend company training courses, both in the techniques of your field and in broader skills, like public speaking or negotiating. It’s good for Exxon that Clifton Garvin is impressive in congressional hearings, on television, and at annual meetings, and the courses he took are one reason why he is.

After five or six years in his specialty, an employee on the fast track might spend another four or five years moving through staff and supervisory jobs in other specialties. The idea behind this is that a really good manager has to learn how to manage anything, even if he doesn’t have any expertise in it. Often a promising middle manager trained in chemical engineering will find himself challenged by being put in charge of a unit in, say, land management, whose work he barely understands, supervising people who have the expertise he lacks. At this point, a rising employee might attend a company course in the techniques of management.

After some time in another field it is important to get back to your original specialty, whether it was geophysics or accounting (to move on to another new one can be fatal), but in a position of real responsibility. In the field, the hierarchy of such jobs would be coordinator, then district manager, then division manager, and finally operations manger. In production, for instance, a district manager might run everything out of the Corpus Christi office; a division manager might be in charge of all production in the central United States; and an operations manager would oversee all domestic production. Interspersed with these field jobs would be more time back at headquarters, ideally as assistant to some very high-level official. If all these hurdles are cleared, the next step would be a vice presidency and then a whirlwind of executive vice presidencies, executive assistantships, and presidencies of minor Exxon companies. As an example of the relative status of such jobs, a few months ago the president of Exxon Pipeline was promoted to the position of executive assistant to Exxon Corporation’s president, Howard Kauffmann. Schooling during this final polishing period might take place outside the company at a special course at some prestigious university—for instance, Harvard Business School’s thirteen-week advanced management program. At the end of the road would come a place on the board in New York.

A look at the histories of the high executives mentioned so far sheds some light on the route upward. All of them but Barrow are engineers. Garvin is a chemical engineer who graduated from Virginia Polytechnic Institute and son of a district manager for Safeway in Portsmouth, Virginia. Kauffmann is a mechanical engineer who went to the University of Oklahoma. Monroe Rathbone was a chemical engineer from Lehigh University. Garvin, like Rathbone, spent his formative years rising up the ladder at the Baton Rouge refinery, Exxon’s largest and a traditional breeding ground for high executives. Garvin also served in two other common fast-track jobs—vice president of Humble (predecessor of Exxon USA) and executive assistant to the chairman of the board. Refining is the greatest producer of board members, followed by production, then by exploration, and finally by marketing. But by the time a man gets to the board his experience is never limited to one field or one place. When he ascended to the chairmanship, Garvin had already worked in Baton Rouge, Tulsa, Midland, Houston, Los Angeles, and New York and had been president of Exxon’s chemical company as well as a refinery manager. Like many Exxon executives, he had become vaguely a citizen of the Sunbelt, perhaps more of Texas and Louisiana than anywhere else, but really he was a citizen of Exxon.

Of course, this world of the successful is completely alien to most Exxon employees. For them, the hi-pos are confident, well-spoken young men and, ever so rarely, women who whiz through their offices for a year or two on their way to somewhere else. The average middle manager in the company isn’t on the fast track, doesn’t know personally anyone who is, and has no idea how to get on it. Even people in the high-potential group often have to reconcile themselves to the harsh realities of the promotion system: on each succeeding step up the ladder there is room for fewer people, and even some of the best have to be left behind. “Exxon likes to hire only potential presidents,” says one employee, “so there are an awful lot of unhappy people around.”

A good number of these people leave for the ample outside opportunities that are available to any presentable Exxon employee. Some completely give up trying and become deadwood; right now Exxon has a de facto tenure policy for all but the most blatant malefactors. One female employee told me that a male Exxon manager could, starting tomorrow, do nothing at work but read the newspaper and would probably last seven more years, and that a woman, in these affirmative-action times, would probably last ten. The company will spend long hours counseling anyone who seems unproductive or unhappy in an effort to get him back on the track.

But most people at Exxon who are no longer advancing neither leave nor completely give up. Some are craftsmen who can contentedly study fossil formations for thirty years. More stay on because it’s their best option. They stay for the thrift fund, to which they can contribute part of their salary and have it matched by Exxon. They stay to become eligible for a pension. They stay for the Employee Stock Ownership Plan. They stay because they have heart trouble and Exxon provides excellent medical coverage. They stay because it’s a secure job, because the raises keep coming, because there’s always the possibility that something will change. Their attitude, despite what the oil companies say about the distinctiveness of the free enterprise system, is one that’s no less common at Exxon than in the civil service, probably even in the Kremlin.

Woody Dinstel was one of those people. After he got out of the Army in 1946, Dinstel enrolled in geophysics at Lehigh University, figuring that would be a way to combine his love of the outdoors and his talent at mathematics. When he graduated (with honors) he went to work for Conoco, doing seismic testing and subsurface mapping on field crews. In the next three years he worked in Rock Springs, Wyoming; Limon, Colorado; Durant, Mississippi (where he met and married his wife, Ruth); Billings, Montana; Ponca City, Oklahoma; Pecos, Texas; and Sterling City, Texas. At the end of that time he quit Conoco. He wasn’t getting promoted, and, because he is a small, feisty, talkative man from New Jersey, he had trouble getting along with the laconic Southwesterners who populated the crews and, for that matter, the oil business in general.

The Dinstels drove from Texas to Ruth’s parents’ house in Durant with their infant son and all their possessions, and Woody sat down and wrote a lot of letters to oil companies. He got a positive response from Carter Oil, an Oklahoma-based company owned by Standard Oil of New Jersey that was sort of a miniature Humble. He started with Carter in Shreveport, where he stayed six months; then went to the Jackson office; and then overseas for nine years. At that time Jersey owned dozens of companies, all operating in different places and under different names, but New York coordinated their operations and finances, and it was common for personnel to be “loaned” back and forth among them. Dinstel worked for a year in Calcutta in the employ of Standard-Vacuum (a Jersey-Mobil joint venture), for three and a half years in Caracas for Creole Petroleum, and in London for five years for Esso Petroleum.

“All these years,” Dinstel wrote Tom Barrow much later, “were my glory years with Exxon and its affiliates. The geology was big, unknown, fascinating, and challenging. I worked with small staffs, had promotions, raises, and recognition. To top it all off, it gave me great satisfaction that a fellow alumnus of Lehigh University, M. J. Rathbone, had reached the top with Jersey.” Dinstel’s job was to interpret seismic records as part of the effort to decide where to drill. For the most part, the areas he studied were previously uncharted. When he made a presentation, it was usually to a high-ranking executive. Sometimes he also supervised other geologists and geophysicists.

In 1965 Dinstel asked for a domestic assignment because he wanted his kids (there were three of them by now) to grow up in the United States and go to American schools. The company moved him to Tyler, Texas, and that was when the glory years ended.

Dinstel’s new employer was the Humble Oil & Refining Company, but not the old Humble. To anyone who used to work for it, the distinction is important. For forty years, Humble was the class of the Texas oil and gas business—the best paying, the best staffed, the best at finding oil, and a Texas company, founded by Texans and headquartered in Texas. In the early fifties, when Dinstel was working for Conoco, if his seismic crew ever moved to a town where there was a Humble operation, all the crewmen would sneak over and ask for jobs. “Humble was the finest corporation ever created,” says Nick Woodward, petroleum land management program coordinator at UT and a loyal Exxon alumnus too. “Everybody wanted to work there.”

Since 1919, two years after Humble’s founding, the majority shareholder in Humble had been Standard Oil of New Jersey. But for decades Humble was Texas-managed; its relationship with Jersey was arm’s length, in keeping with the parent company’s longstanding policy of decentralization. Humble often sent executives on to Jersey, but Jersey didn’t send bosses down to Humble.

In the late fifties, however, Jersey began to centralize. In 1960 it sent out a tender call for outstanding Humble stock and its ownership became almost total. Then it merged all its domestic oil and gas operations—including Carter, Dinstel’s old company—into Humble, which suddenly became a huge corporation, with $3 billion in assets, six refineries, the largest fleet of tankers under the American flag, and gas stations in 43 states. In 1963 Jersey sent John Kenneth Jamieson (later a chairman of the board of Exxon) down to Houston to assume Humble’s presidency and begin a consolidation process that eventually cut the Humble work force by 20 per cent. In 1966 an executive vice president of Jersey (and a Carter alumnus), Myron A. “Mike” Wright, became Humble’s first outsider chairman, and its last—in 1977, when Randall Meyer became the head man at Humble, it was with the lesser title of president. On January 1, 1973, the process was completed with the changing of Humble’s name to Exxon USA.

These changes may seem only to have made explicit the already existing relationship between New York and Houston, but their symbolic significance was enormous. Even people who liked the new Jersey-controlled Humble better than the old independent one say that Humble somehow had a family feeling that was lost in the early sixties. And for the majority who didn’t like the change, the memories of those years are bitter ones. “Humble changed from a very personal company to an impersonal one,” says one man who left the company in 1973 after 28 years. “We lost our names and became numbers and fitness reports. We had wonderful sprit de corps at the old Humble. It was like being on a winning football team. You knew everybody. You could be outspoken and critical. Then all of a sudden top management came in and we lost our identity. It changed from a vibrant oil company to a banking situation.”

The transition was so strongly felt by Humble employees partly because it was the most readily available symbol of the changes in Texas from the era of the family business to the era of the giant corporation, and partly because it came at a time of other momentous shifts in the oil business. The sixties were the years of too much oil. All the major companies had huge fields in the Middle East and Latin America—big enough, it seemed, to guarantee decades of cheap crude. The problem the companies faced was not how to get oil, but how to produce and refine it efficiently and sell it in sufficient quantity—hence the free-steak-knife deals that proliferated at gas stations in those years.

So, in the exploration end of the business, particularly the continental U.S., the sixties were bleak years. The fate of the independents, whose only job is finding domestic onshore oil and gas, is an example: between 1957 and 1973 their numbers shrank from 20,000 to 10,000. Among the majors, Gulf practically announced that it was no longer interested in domestic exploration because of its tremendous reserves in the Persian Gulf. Texaco concentrated on putting gas stations in all fifty states. Only Exxon, of the majors, was reasonably farsighted—Rathbone insisted on continuing to plow money into domestic exploration in Alaska and other places and was considered an eccentric for it. Even so, the times were such that at Humble the emphasis shifted somewhat, away from exploration (which is, really, the source of almost all the romance and legend of the oil business) and toward refining and marketing.

Woody Dinstel stayed in Tyler for two years, until the office was closed down in the centralization process and he was transferred to Houston. Right from the start his work was different from what it had been overseas. He was doing, he says, work that a guy just hired would do—mapping areas in East Texas that were easy to plot and had been mapped before. Dinstel was 39 years old and bored. He tried to find another job, but, those being bad years for explorationists, he couldn’t. He began to think about early retirement. The policy was that if you were at least 50 and had been with the company at least fifteen years you could, subject to Exxon’s consent, leave and receive an annuity comparable to what you would be eligible for at 65. In those years, in exploration, the consent was pro forma. So for Dinstel, that meant a little more than ten years of waiting.

The work was even worse in Houston. After six months Dinstel was made a velocity specialist, which he remained for the rest of his time with the company. Velocity is a small subdivision of geophysics in which a scientist does mathematically roughly what a bat does instinctively: measures the speed of waves, in this case seismic waves, as they move through the earth. Variations in the speed of the waves can sometimes indicates the presence of hydrocarbons, particularly natural gas. For six years Dinstel was a velocity specialist for the Gulf of Mexico, and for four years for the Gulf of Alaska. It was monotonous, almost clerical work. “I wanted to be directly associated with an oil or gas discovery,” he says. “To me that’s the measure of your success. You’ve got to feel like you’re worth something. And I didn’t feel like I was worth anything at Exxon.”

For ten years Dinstel told his supervisors in his fall performance reviews that he was bored, stale, wanted a transfer. He asked them whether Exxon wanted him to quit. He went back to school at the University of Houston and got his master’s. He published an article in Geophysics, the magazine of the Society of Exploration Geophysicists: “Velocity Spectra and Diffraction Patterns,” by Woodrow L. Dinstel. None of it helped. He was in his forties, too old for the fast track, working for a man who wasn’t going anywhere either. His supervisors told him he was smart and hardworking but too impulsive.

He became increasingly depressed and frustrated. His marriage began to sour. He advised his son, who was in college at Baylor, to pick a career in some field other than geology. More and more, he looked forward to the day when he could retire. “I knew there were interesting jobs at Exxon,” he says, “but I was on the shelf, and once you’re there, you stay. I hung on for ten miserable, stinking years, thinking, ‘Boy, when I’m fifty, I’m gone.’”

Woody Dinstel turned fifty on November 7, 1976. On December 21, 1977, he put in for early retirement. For a year, in his words, he “stumbled around.” After all those bad years, it was harder than he thought it would be to leave Exxon. Part of it was the hope that if he stuck it out a little longer something might change, but another part was that, while in his head he knew Exxon was just a huge corporation, in his heart he wanted it to tell him he was a success, not a failure.

What made him finally take action was that the oil business was changing again. The days of cheap, plentiful foreign oil were gone. All over the world, oil-producing countries were nationalizing, raising prices, increasing their share of the take. At gas stations, the steak knives gave way to Spartan self-service pumps. Domestic exploration was important again, and explorationists—from students to men in their fifties—were a hot item. Dinstel’s friends in the company were leaving in droves for better paying, more challenging jobs with smaller companies. People the company badly needed were taking advantage of the early retirement program, which was designed to ease out middle-aged deadwood.

At Mobil the exodus has been so serious that this year the company took Superior Oil to court for stealing its people. At Exxon USA, a chart the company sent its employees this summer showing the number of employees in various age groups shows a deep valley in the 35-to-45 range, between the twin peaks of 25 and 29 and 50 to 54. The company will rejuvenate itself, of course, simply by bringing along the younger generation more quickly, but it has been constantly increasing public relations efforts aimed at its own employees. It publishes magazines, newsletters, even an employee TV show called This Week at Exxon, all stressing the company’s broad range of activities, its generous benefits and pensions, its concern for the environment, and its place in the free enterprise system.

The happy reports from his friends who had left encouraged Dinstel to make his break, and in August 1977 he began to send around his résumé. He was still confused about his intentions. One side of his plan was that after he had gotten another job and put in for early retirement the company would realize the error of its ways toward him and give him a transfer and a raise. On the other hand, a couple of recent events had pushed him the other way. The man who had hired Dinstel at Carter and the man who’d been his first boss there had both been district geophysicists, an important and respected position. But with the consolidation of the sixties their careers had taken a downward turn. For years these proud men drifted slowly lower in the company, filling less and less responsible jobs. The man who hired Dinstel took early retirement and six months later shot himself. On Christmas Eve of 1977 Dinstel’s first boss got out his gun, killed his wife, and then killed himself.

A few days after that Dinstel had his retirement lunch and went home to use up some of his vacation time before leaving the company. After a couple of weeks his boss called him at home and said there had been some problem and his early retirement might not come through. Then he called again and told Dinstel he’d better come back to work. He did, and a few days later, two of his supervisors called him in and said that management had decided not to grant him early retirement after all. They told him if he wanted he could go see John Loftis, senior vice president for exploration, and talk it over with him.

Loftis told Dinstel that he had decided to exercise his option of turning down the requests for early retirement of people who wanted to leave Exxon to work for other companies. Dinstel could either stay on at the same level or quit. Dinstel said that he had been stagnating for ten years, that he had looked forward to early retirement for all that time, that he was tired of sitting around drinking coffee all day. “Stay on and we’ll motivate you,” Loftis said. Dinstel went back to his office and cleared out his desk.

When Ruth Dinstel heard the story, she called up Randall Meyer himself and was put through to Meyer’s assistant. She had been a loyal Exxon wife for 23 years, she said. She had defended the company when people criticized it. She felt betrayed by the treatment of her husband. Meyer’s assistant said they’d get back to her.

A few weeks later Loftis called Mrs. Dinstel. He was very polite. He said Meyer had referred her phone call to him and apologized for taking so long to get back to her. He said Exxon would love to have her husband back, but if he wanted to leave, the company wouldn’t give him early retirement. Exxon couldn’t afford to subsidize other oil companies, he said. So it was over.

Dinstel thought about the whole incident a lot later, about what they had done wrong and what he had done wrong. He should have done a lot of things. He should have retired a few months earlier, when early retirement was still being freely dispensed. He should have told his son to become a geologist. He shouldn’t have told the company he had another job lined up. Months later, it finally came to him what his central mistake had been. “One time a friend of mine was complaining to me about how bad the company was,” he says. “How unfeeling it was, how cold. I said to him, ‘You know what your problem is? You want the company to love you.’ And that’s what I realize now. I wanted the company to love me, too.”

- More About:

- Energy

- Business

- TM Classics

- Longreads