Former Governor Rick Perry’s mantra was that the Texas economy is served best when state lawmakers “don’t spend all the money.” That doesn’t mean Perry was against spending money, and he exploded when one legislative session ended with the Legislature leaving unspent $2.2 billion in general revenue and $4 billion in the Rainy Day Fund. “Generally speaking, it’s not the investments made in the budget that concern me,” Perry told the Austin newspaper. “It’s the charades; it’s the accounting sleights of hand; it’s the budgetary wizardry that gives me pause, especially with the state awash in revenue.”

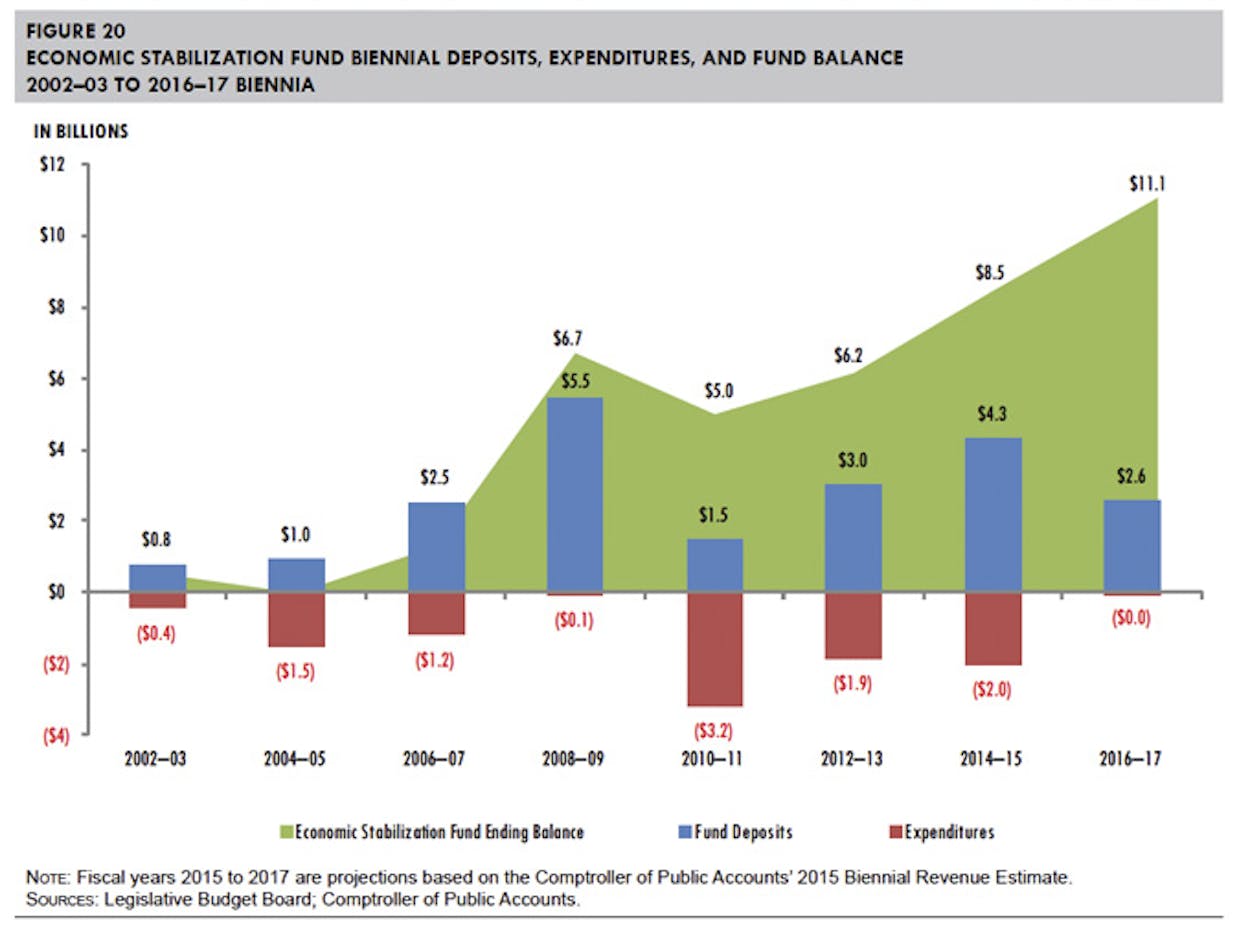

Some things never change. The House Appropriations Committee this week sent the full House a $210 billion, two-year state budget that looks less like a paragon of fiscal conservatism than it does like a candidate for a reality television show on hoarding. The proposed House budget leaves $2 billion unspent from general revenue and $11.1 billion from the Rainy Day Fund. The budget also includes $4 billion in retained dedicated funds that can be used to certify the budget as balanced.

House leaders today announced they are going to add $800 million to the state’s budget in an effort to settle a school finance lawsuit brought by districts after the state cut $5 billion from education funding in 2011. That would leave $1.2 billion unspent. The yet to be seen House tax plan will whittle this amount down some, but overall this is a budget to make the legislators who ticked off Perry look like pikers.

Meanwhile, the Senate today took up legislation to reduce homeowner property taxes and lower franchise taxes for small businesses. It was a tax cut field day for the Senate’s Republicans, with votes they can carry to the electorate next year. Senators also approved a proposed constitutional amendment to bar the taxation of real estate transfers – that’s a tax that has never been collected. They also eliminated the estate tax, which has not been collected on any death since 2005. Senators also gave a $1.2 million tax break to the industry of boxing, kickboxing and mixed martial arts. Ki-ap! Take that House!

The Senate tax package is part of Lieutenant Governor Dan Patrick’s everybody’s a winner at the next election strategy. Patrick, however, has made the same mistake former House Speaker Tom Craddick did a decade ago by pushing forward a tax cut package without consulting the state’s business community. Big business killed Craddick’s package. If big business doesn’t kill Patrick’s tax package, the bills will return to him emasculated in the House. Big business doesn’t like the floating homestead exemption in the property tax relief bill because in a down economy it puts a greater burden on business to pay for the state’s schools. And the franchise tax relief for small business goes against an agreement made in 2006 to pass property tax relief that year.

The House budget in many ways follows the political positioning of Governor Greg Abbott, Patrick and House Speaker Joe Straus. More than that, though, it reflects genuflection to the two idols of state budgeting: the spending limit and sanctity of the Rainy Day Fund, whose real name is the boring Economic Stabilization Fund.

My colleague Erica Grieder has made a compelling argument against busting the spending cap. I can’t agree, mostly because the spending cap, like creation of the Rainy Day Fund, originally was passed as a gimmick by lawmakers fending off angry taxpayers. The Dallas Morning News in 1978 called the spending cap amendment to the state Constitution a “cruel hoax,” because it allowed state lawmakers to determine for themselves what the limit is, giving them cover for however much or little they want to spend. The Rainy Day Fund was created in 1987 to protect lawmakers who were voting for a $5.7 billion tax increase to pay for a budget shortfall caused by an oil and real estate induced recession. The Rainy Day Fund was like saying, we’re raising taxes but we’ll never let it happen again. As Bob Garrett of The Dallas Morning News notes in a recent story, the fund rarely had more than $300 million in it until recent years. The fund has become a shrine to the state hoarding money, as you can tell looking at the graphic at the top of this blog. Money has been withdrawn from the fund in each of the past three budget cycles and it has continued to grow without collapsing state government.

Neither the spending cap nor the Rain Day Fund is sacred. Besides, I’ve never seen the Texas Legislature as a place filled with profligate liberals.

To create a strong economy in the long term, a state should not overburden its people or businesses with high or unfair taxes, and it needs to adequately finance transportation and education. The state of Texas tax system creates boom and bust cycles, so judge that for yourself, and in recent years the Legislature has been starving both transportation and education funding in the name of fiscal conservatism. Revenue is available right now, without tricks, to provide one-time funding for roads and bring school finance back on track to create an educated work force for the future.

Coming below are some graphics on the House budget. The first is the all-funds budget. That means money from state tax revenues and fees as well as federal funding. Wow! Look at that giant $2.8 billion cut in the Natural Resources budget.

This does not actually mean state spending is going down that much. On the face of it, the House budget cuts $2 billion from the Water Development Board budget. When voters approved Proposition 6 for water development funding in 2013, it prompted a transfer of $2 billion to state water funds as the seed money for what essentially is a revolving bonded loan account to help pay for $27 billion in water projects over the next 50 years. The House budget expects the Water Development Board to finance $1.4 billion in water projects in the upcoming two years alone.

One thing you’ll note is that public education funding is up $300 million. That’s because most of the increase in the public education budget is coming from the Property Tax Relief fund set up by the Legislature in 2007 and is not included in the General Revenue budget. Using that money, the House proposes increasing state payments to schools by $2.2 billion over what the funding formulas require. The spending cap applies to the Property Tax Relief Fund, which is why some lawmakers want to exempt it from the cap in the future.

My last two graphics are some examples of what is happening to cause increases in state spending.

For the hardcore mooks among you, the entire Legislative Budget Board analysis of the House Bill 1 budget can be found here: Summary of Committee Substitute for House Bill 1 2016-17. It contains all the information you need to make the case that the Legislature is shortchanging state government or that its spending is running away with the taxpayer’s money.

rgratcliffe@outlook.com