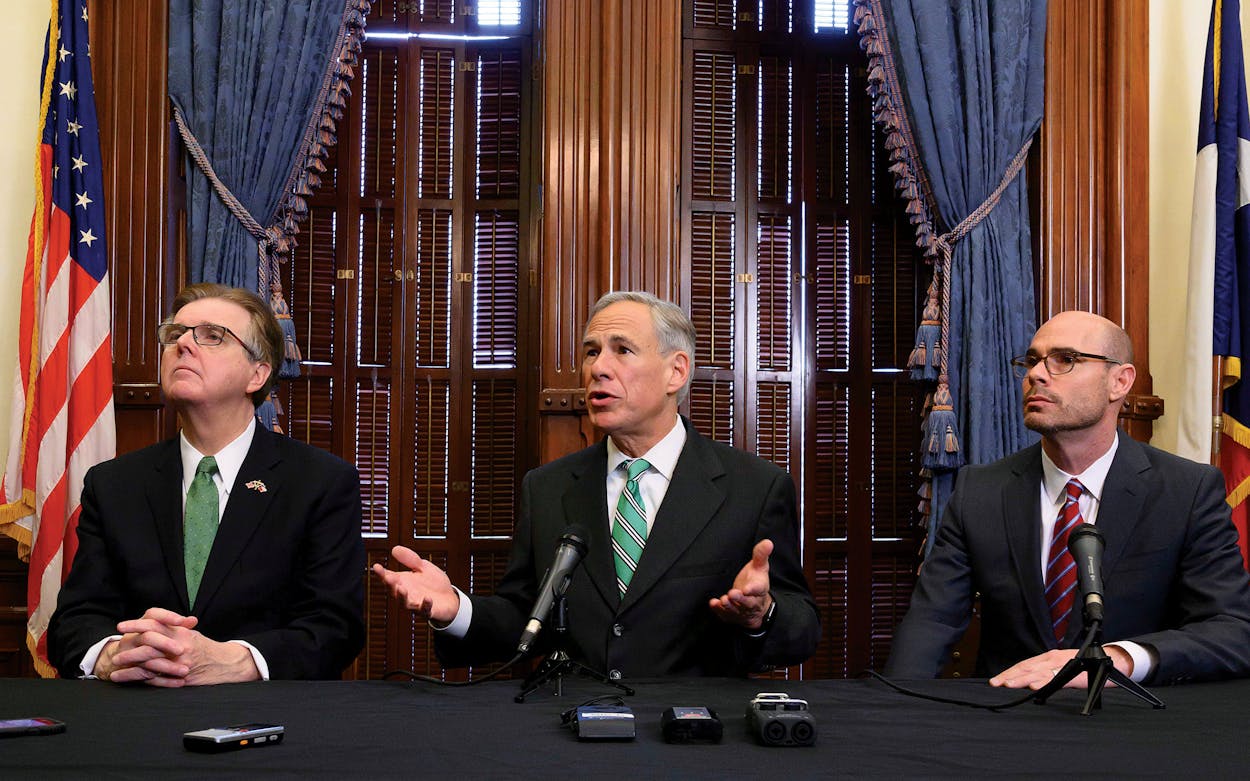

Governor Greg Abbott often promises to oppose policies that would turn Texas into California. But on Wednesday, the governor, along with Lieutenant Governor Dan Patrick and Speaker of the House Dennis Bonnen, proposed a sales tax increase that would put the Lone Star State in line with the Golden State for the highest sales tax rate in the nation.

The three Republican leaders are proposing to increase the statewide sales tax by one percent, from 6.25 percent to 7.25 percent. Combined with local sales tax, many jurisdictions could see a rate as high as 9.25 percent. Under the plan, the billions in additional revenue would be used to lower property tax rates, though many homeowners wouldn’t see lower property tax bills because of how fast home values are increasing. The unexpected move is meant to free a potential legislative logjam. Passage of property tax bills in both the House and Senate has been uncertain because of concerns that the proposed legislation would be too onerous on fast-growing local jurisdictions that rely on the tax to keep up with growth.

Is such a proposal, coming just one day before the full Texas House and possibly the Senate are scheduled to debate their property tax relief bills, a bold commitment to fulfilling the priority of property tax relief, as the conservative Texas Public Policy Foundation called it? Or is it a Hail Mary aimed at bolstering support for legislation on life support?

Regardless, it’s extraordinary that three Texas Republicans are proposing any kind of tax increase—an unusual moment in Texas politics that Democrats were quick to seize upon.

So the Republicans are the one California-ing my Texas 😂

— Dr. Michael Peyton (@MPEYTO) April 10, 2019

The one-penny proposal pits most of the state’s big city mayors, almost all Democrats, against the all-Republican leadership at the state level. And it pits rural counties, which would not be affected as much by the current property tax reform measure, against urban counties, which are squarely in the crosshairs of the proposed tax relief legislation.

Conservatives have generally been more favorable to consumption taxes, arguing that they preserve consumer choice. But Ann Beeson, the head of the left-leaning Center for Public Policy Priorities, said the sales tax is one of the most regressive and volatile taxes, one that disproportionately affects the poor and middle class. “These households usually spend most of their income providing for their families,” she said. “Wealthier families can afford to set aside savings or spend money on nontaxable services like lawyers or accountants. As a result, lower-income Texas families pay 7.4 percent of their income directly or indirectly in state sales taxes, while wealthier income families pay only 1.6 percent.” She also raised concern about relying on sales taxes as a revenue source because revenues fluctuate dramatically based on the rhythms of the broader economy. “This volatility has already caused difficulties in the state budget, which is highly dependent on sales taxes, forcing cutbacks in school funding and making long-term commitments difficult,” she said.

The penny-tax proposal will require a constitutional amendment, which means that the legislation must pass each chamber with a two-thirds vote. Democratic support is a must, and early indications suggest that may not be easy to secure. “It’s a dangerous idea, one that increases taxes on working families to disproportionately provide tax cuts for corporations and the rich over everyday homeowners,” said Representative Ramón Romero, D–Fort Worth, on behalf of the Texas House Democratic Caucus.

There’s another major impediment in the property tax proposal that must be overcome: Patrick, Bonnen, and Abbott want to force an election on any local proposal to raise property taxes by more than 2.5 percent annually. (Currently, voters can call for an election if local property taxes go up 8 percent or more year over year.) But many lawmakers believe the proposed 2.5 percent cap is too low, an argument made by Texas mayors who said such a cap is lower than the rate of inflation. If a taxing authority collects more than $15 million, it is not subject to the lower threshold—which is a problem for some lawmakers who believe there should not be two standards for different jurisdictions. Raising the trigger to 4.5 percent may make the legislation much more palatable to reluctant lawmakers than the penny sales tax increase. The first test of that notion is expected to come Thursday when the full House debates HB 2, its version of the property tax reform. And late Wednesday, there were suggestions that the Senate may be ready to debate its own version of property tax reform as early as Thursday as well.

- More About:

- Politics & Policy

- Greg Abbott

- Dan Patrick