Amid a frog-drowning on Sunday, several dozen members of the Austin Tesla Club gathered jubilantly in a parking lot in East Austin. Masked fans cheered as a middle-aged man flashed the Bevo with one hand and fired a flamethrower with the other. The crowd was there to celebrate the deal between Travis County and the electric car manufacturer, inked late last week, to build a $1.1 billion, two-thousand-acre factory, named Giga Texas, in the tiny municipality of Del Valle, near Austin-Bergstrom International Airport.

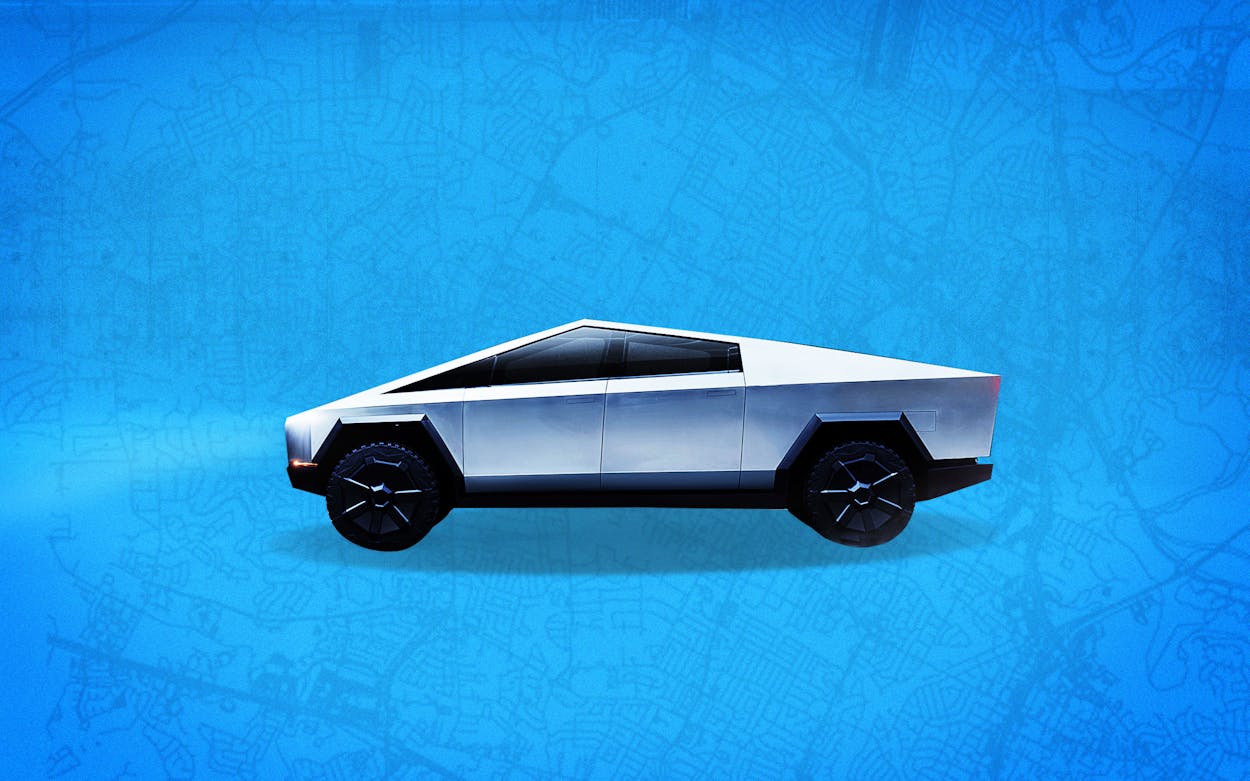

The proposed Tesla plant, which will produce Cybertrucks and Model Y SUVs, is expected to be a billion-dollar investment that will employ five thousand in manufacturing jobs and benefit hundreds of contractors and suppliers. When the deal was announced, Tesla said that about 65 percent of the factory’s jobs will be “middle-skilled” and will not require college degrees, with salaries starting at $35,000 a year and averaging more than $47,000. The company pledged to make at least half of its hires from among Travis County residents, and stated it would make a “good faith effort” to hire women and people of color.

The deal was praised by Governor Greg Abbott, the Austin Chamber of Commerce, various local labor groups, and leaders of job training programs. “It’s like winning the lottery …,” said Ed Latson, CEO of the Austin Regional Manufacturers Association.

To win this much-needed boost to its virus-impaired economy, the Austin area had to outbid Tulsa. Most of the incentives came in the form of tax breaks, though Tulsa also repainted its iconic 75-foot-tall Golden Driller statue in the likeness of Tesla CEO Elon Musk.

Many involved in Austin’s bid for Tesla drew different lessons from the city’s failed 2018 pursuit of Amazon’s gleaming $5 billion HQ2. That deal went to two bigger metro areas: Arlington, Virginia, just west of Washington, D.C., and New York City—which ultimately backed out after a public outcry over the cost of its subsidies, roughly $48,000 for each job created. Proponents of the Austin area’s deal with Tesla say that it represents a bargain, at about $1,200 in annual subsidies for each job created. But a coalition of community groups and labor rights advocates argue that the concessions to Tesla are too expensive, and that the deal’s terms undercut the very manufacturing workers it is supposed to benefit.

The Del Valle Independent School District, which received a C under the state’s letter-rating system, played an integral role in wooing the electric car manufacturer. Del Valle, which has become a target for developers, is a rural section of Austin’s low-income “eastern crescent” fit for a large factory. Through Texas Tax Code Chapter 313, also known as the Texas Economic Development Act, a school district can reduce the property taxes of a new business seeking to relocate to its jurisdiction to an amount below those paid by other property owners. In Tesla’s case, the incentive agreement allows the company to cap its property value at $80 million, as opposed to its projected $1.1 billion valuation, meaning that Tesla will pay just $776,000 a year in property taxes for the first ten years, as opposed to the more than $5 million it would pay without the tax break. The Tesla property’s current tenant, a gravel mining facility, pays just $6,400 a year in property taxes, and few of the children of Tesla employees will attend school in Del Valle, whose population is about 17,000. But the cost of educating the children of new Tesla employees moving to the Austin area will fall on the area’s schools.

Del Valle ISD’s incentives were matched by Travis County’s, which will give Tesla additional property tax rebates worth $14 million over ten years. If Tesla were to spend more in operational costs than the $1.1 billion proposed, the company’s subsidies would only increase: a 75 percent tax break for any spending between $1.1 billion and $2 billion; an 80 percent break for spending above $2 billion. Tesla, whose press team did not respond to requests for an interview, could also unlock state support from the Texas Enterprise Fund, which offers grants to companies that create jobs in Texas rather than in other states. While neither party has said how much these funds will amount to, comparable allocations to organizations such as Apple have been north of $21 million over sixteen years.

Supporters of the deal believe Tesla’s promised internships and job training programs can transform the region, providing an attractive return for the local governments’ tax incentives. “The prospect of Tesla being in our community was exciting for the opportunities that would come to fruition for our students,” said Del Valle ISD Superintendent Annette Tielle in a statement provided to Texas Monthly.

But most of Tesla’s negotiations took place behind closed doors, leaving community groups and stakeholders out of the process. The lone dissent in the Del Valle ISD school board’s 7–1 vote in favor of the deal came from trustee Susanna Woody, who said the vote felt “completely rushed.”

“When you’re staring at a budget deficit of billions of dollars due to COVID and you’re talking about giving any money to a billionaire, that’s a tough thing to swallow,” said Rick Levy, president of the Texas chapter of the AFL-CIO.

Critics argue that incentives such as Chapter 313 prioritize the interests of multinational companies over those of taxpayers, often unnecessarily. University of Texas professor of government Nathan Jensen, who models the use of tax incentives to bring business to the state, estimates that 85 percent of companies would have relocated to employer-friendly Texas without the likes of Chapter 313 incentives.

“Even if we know an incentive will swing an investment, it is rarely a win for the local community. First, what [else] could the community have done with this money? Could they have offered $50 million to small businesses that are already here?” Jensen said, citing the incentive package from the Del Valle ISD. Likewise, many companies end up having to leave these incentives on the table, after bringing fewer jobs or less investment than initially expected.

This is not the first time local governments have offered Tesla incentives to build new factories: Nevada gave the company a $1.3 billion tax break to build its first Gigafactory outside Reno in 2014. Six years later, the plant contributes billions of dollars to the local economy and employs seven thousand workers. But local activists and labor groups have raised concern over the plant’s strain on the housing market, and its worker safety record. In 2018, the company ranked amongst the nation’s “Dirty Dozen” for employers engaging in unsafe practices, according to the Council for Occupational Safety and Health, a worker-safety watchdog. A 2019 USA Today report detailed both a culture of negligence at the Reno facility that placed manufacturing employees at risk and the misreporting of injuries to the Occupational Safety and Health Administration. Tesla also came under fire this month after an outbreak in its Fremont, California, plant for not taking the necessary precautions against the spread of the coronavirus, whose severity Musk has publicly questioned. (Tesla maintains that its safety standards are on par with the overall manufacturing sector, and a spokesperson told USA Today that a “few isolated incidents … are not representative of our overall safety culture at Gigafactory 1.”)

In its agreement with Travis County, Tesla will be enrolled in OSHA’s voluntary protection program, designed for “employers who have implemented effective safety and health management systems.” Travis County also laid out a set of best practices for Tesla to follow to protect its workers. But detractors, including Emily Timm of the Workers Defense Project, an Austin-based organization fighting for low-income workers, argue that the deal’s language is vague and grounded largely in unenforceable, good-faith agreements.

While labor rights activists support Tesla’s stated commitment to a minimum wage of $15 an hour, substantially above Austin’s $7.25, the agreement sheds no light on which workers this standard applies to. The average hourly rate for manufacturing jobs in the U.S. is $22. “The fear is that a company like Tesla keeps its high-level creative jobs in places like the Bay Area and begins to see Austin like a low-wage, high-tech town,” said Doug Greco, lead organizer of Central Texas Interfaith, representing a coalition of nonprofit groups in Austin.

But to a school district and a county suffering from financial distress, the promise of new jobs and tax revenue was too good to pass up. “Tesla’s making real contributions back to the school district. It’s developing a site that was previously a mine,” said Laura Huffman, CEO of the Austin Chamber of Commerce. “So the value trade in this deal with Tesla, I think, is strongly in favor of the community. And it was necessary because we were competing.”

- More About:

- Politics & Policy

- Business

- Public Schools

- Austin