On the House floor on Tuesday state Representative Dan Huberty wrapped a flag around the bloated corpse of the sales tax swap, saluted it, and pushed it out to a watery grave. Thus ended one of the session’s most high-profile policy proposals, an initiative to shift more of the state’s tax burden from property owners to its poorest residents by raising the state sales tax. This move had the public backing of Governor Greg Abbott, Lieutenant Governor Dan Patrick, and House Speaker Dennis Bonnen. What happened?

Politics can be complicated, but there are some simple rules. Cutting taxes is popular; raising taxes is unpopular. That’s why, following a scare in the 2018 midterm election, the Republicans who lead the state placed a heavy emphasis on property tax “relief” this session. If they could make that work—big “if”—it would be very popular.

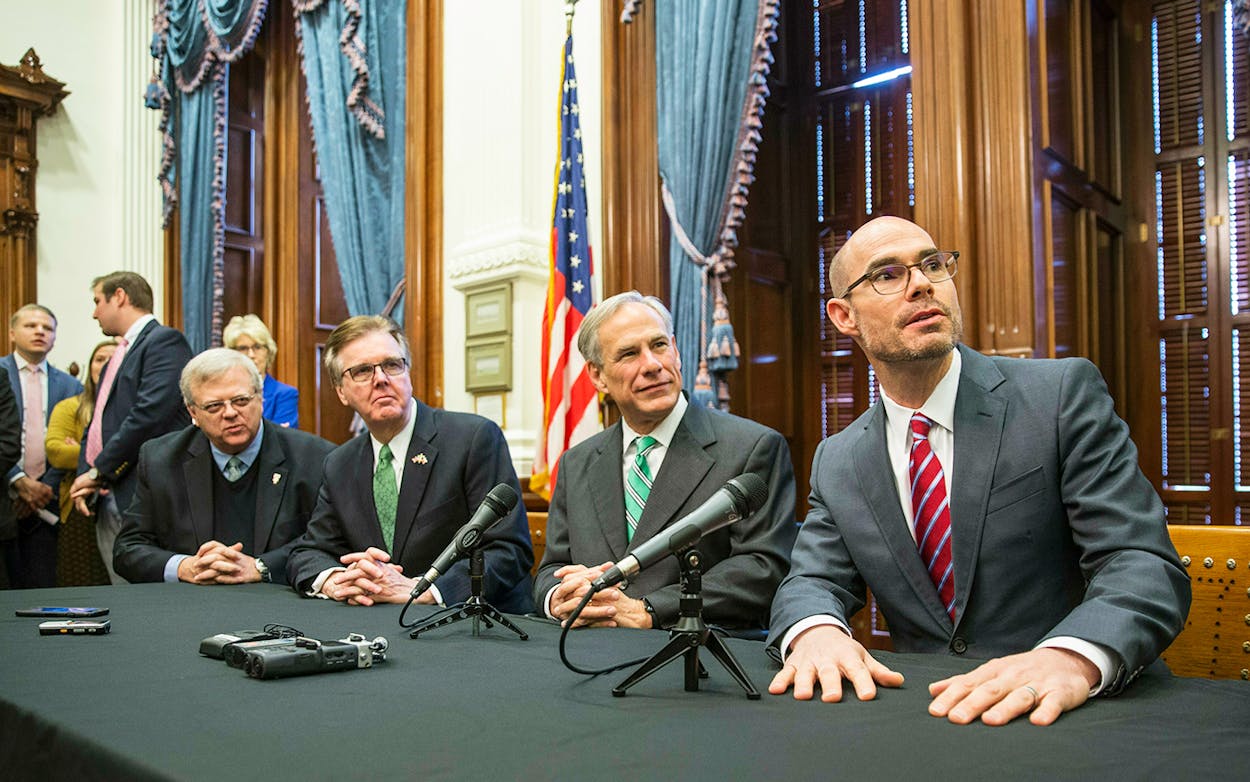

And then on April 10, something very confusing happened. Abbott, Patrick, and Bonnen announced that to pay for a modest reduction in property taxes, they would raise the state sales tax by a penny—thereby tying Texas with California as the state with the highest sales tax. It’s unusual for the big three to come out unified like this. At a press conference last week, they did so again, vowing their continued support and strong belief that the thing would soon pass.

The “swap” would significantly shift the cost of funding state government. Texas families making less than $100,000 would see the amount they pay in taxes go up, with the poorest taking the biggest hit. Families making more than $100,000 would get a modest tax cut. The biggest savings would go to the richest families in Texas, who own the most property. Is this good policy? A lot of people, on the left and right alike, argued that it wasn’t. But the question of the politics of the thing was even more confusing.

If you’re asking lawmakers to vote for a tax change, the bill should ideally help their constituents more than hurt them. If it is a tax hike, it should be for a good reason that can be easily explained to voters. And if it is exchanging one tax for another, the new tax structure should produce less political heat for incumbents than the old one. The swap could meet none of these tests.

Just a handful of state lawmakers represent districts where the average household income is more than $100,000, which is to say the passage of the swap depended on lawmakers voting against the material interests of most of their constituents. To be sure, many of them do so regularly, but not on so high-profile an issue. Raising taxes on the majority to buy down taxes on the wealthiest is a hard case to make. Every lawmaker who voted for the swap would face the prospect of ads about how he or she had raised taxes on diapers and school supplies to help out people with mansions and weekend ranches. The dent in property taxes would be negligible for most, whereas the sales tax increase would be high-profile and have an everyday effect on almost every Texan.

Because the tax swap was hated both by Democrats, who opposed making the tax structure more regressive, and by conservatives, who oppose raising taxes in general, the swap would have exposed Republican lawmakers who voted for it to difficulties in their next GOP primary and the general election. (Left-wing Progress Texas and right-wing Empower Texans hated the swap with equal fervor, which is a minor miracle.) What’s more, Democrats are eight seats shy of winning control of the state house of representatives in 2020. In some districts, GOP state reps won by just a few hundred votes. The governor and leaders of the house and senate were asking those guys to jog back to their districts carrying weights.

Adding to the absurdity, passing the sales tax through a constitutional amendment would have required 100 votes in the house, which meant leadership needed the support of a wide cross-section of both Ds and Rs to get it through. They appear to have never had anything close to that, and they had no real case to make. And they dropped this whole, weird plan less than two months from the end of session. The whole thing is honestly pretty baffling!

The swap would have helped out some wealthy individuals, but the larger benefit would have been to businesses, which own a lot of taxable property. For years, conservatives, led by groups such as the Texas Public Policy Foundation, have advocated cutting or eliminating the business franchise tax and property taxes and replacing them with consumption taxes. That has been such a commonplace idea that it’s easy to understand how Republicans could have generated this plan in an offhand way.

But businesses don’t vote. People do, and state leadership dropped this plan in a year in which incumbents in swing districts are more aware of the people in their districts than ever. Though Huberty “postponed” the bill to 2021—signaling that the Lege would be returning to the issue—the lesson this year seems to be that the politics of the thing are poisonous and not worth returning to. If the consumption tax crowd pushed because they saw an opening, it may have backfired on them.

Who is responsible for this? The big three all endorsed it, to be sure. But Patrick’s been a bit AWOL lately—some days it feels like state Senator Paul Bettencourt, a Houston Republican, is the de facto lite guv of Texas, and he opposed the plan. Bonnen lets the House do its thing, though this plan would have been good for the businesses in his district south of Houston. It’s Abbott, who staked his credibility on the swap, who stands out. The governor has had a hard time maintaining a productive working relationship with the Legislature since he first won office, and this represents another high-profile whiff.

- More About:

- Politics & Policy

- Greg Abbott

- Austin