“Let the Yankee bastards freeze in the dark” was a popular refrain among Texans in the seventies, who felt that the federal government was depriving them of their natural gas by compelling them to ship it to the Northeast and Midwest below cost. Yet it was Texans two weeks ago who were left to freeze in the dark, in their home state.

Governor Greg Abbott and legislative leaders, who are ultimately accountable for overseeing the state’s electric grid, have sought to focus blame on the Electric Reliability Council of Texas, the state’s grid operator, and have lambasted the group for its lack of preparedness. But to focus solely on ERCOT and the electricity system is to miss the key role played by the natural gas industry, which is controlled not by ERCOT but by the Texas Railroad Commission.

Though I live in Houston, I am by birth one of those Yankees to whom Texans have historically directed their ire. I’m now the head of natural gas research at an energy trading company, Mercuria, and the views in this piece are mine, not my employer’s. I was in Utah for the duration of the crisis—don’t hate me for it—but as I worked remotely, I watched energy markets convulse in real time, trying in vain to find an equilibrium that was reached only after power was denied to more than 4.5 million households and businesses.

As the lights flickered and then went dark, almost no one lost gas supply to their homes or businesses. How then could this have been a gas crisis? Simply because, in Texas, gas is the stuff that electricity is made of. Fifty-two percent of the electricity generated in Texas in 2020 was from natural gas, versus only 39 percent in the rest of the country. Of the 82 gigawatts that ERCOT lists as available for this winter’s supply on its official report, the lion’s share, 50 gigawatts, is gas-generated. Plants expected to produce a collective 20 of those 50 gigawatts were not producing power from Monday, February 15, through Wednesday, February 17. Some power plants were unable to run because operators had not taken the proper winterization measures: lines froze and systems could not have run, even with gas supplies. Many others, though, were ready to generate but could not, simply because there was no gas to be had, at any price.

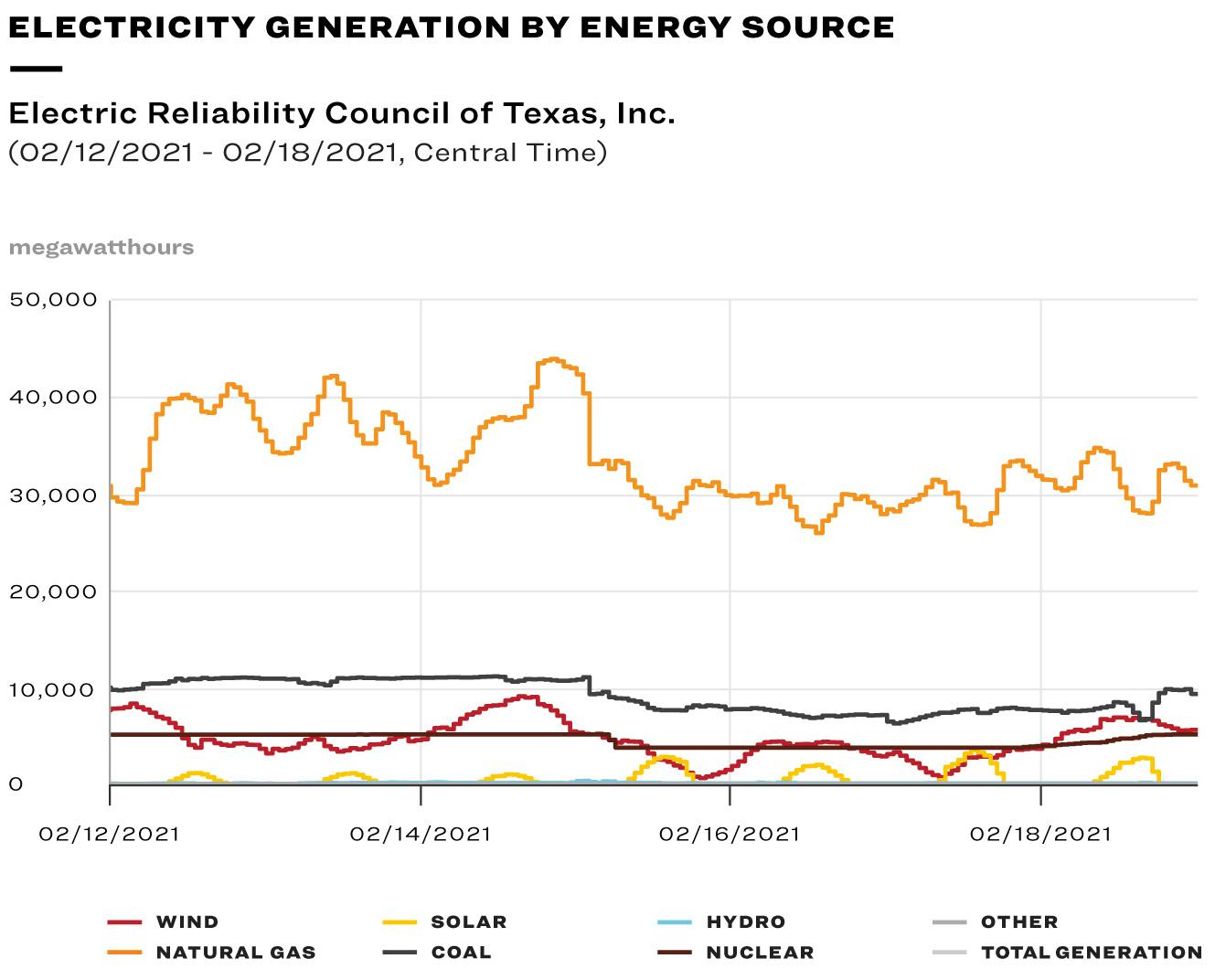

Some people, including members of the Texas Railroad Commission, which regulates the state’s oil and gas industry, and Abbott, have blamed wind for the blackout, but they are either ignorant of the data or pushing an agenda. About 8 gigawatts of wind generation was lost from the pre-freeze peak to the trough on February 15, which was unwelcome, but not unexpected: in its Final Seasonal Assessment of Resource Adequacy, ERCOT modeled a low wind output for the winter of just 1.79 gigawatts. Wind generation dipped as low as 0.65 gigawatts, meaning that the energy source “underperformed,” but less so than the more “reliable” coal, which fell short of expectations by more than 5 gigawatts, and nuclear, which fell short by 0.7 gigawatts. The underperformance of all those fuels paled next to that of gas, though, which generated 16 gigawatts less than ERCOT’s low estimate, and closer to 20 gigawatts below what it was being counted on to produce, in a base case.

Where did the gas supply for these 20 gigawatts of gas generation go? Were producers withholding supplies to get prices up and make a windfall? The answers are: nowhere and no. The gas stayed in the ground, and not only did gas producers not benefit from the high prices, many took major losses. In the low temperatures, the facilities providing one third of the state’s gas production “froze off.” The tanks that separate oil, gas, and water in the field got blocked, choking back production volumes. Had they not frozen, those facilities would have been able to provide enough natural gas to fuel an additional 45 gigawatts of electricity generation—far greater than the shortfall, and enough to have greatly eased, if not altogether avoided, the blackout.

The reason that producers generally do not benefit from the short-lived price spikes that occur during freeze-off events is, first and foremost, because they have less gas to sell. What compounds matters, and exposes producers to losses, is that they are often on the hook to buy gas during these freeze-offs. Both buyers and sellers in gas and power markets contract for most of their base volumes ahead of time, usually for the month, leaving only “swing” volumes to be transacted day by day. This acts as a hedge for both parties, reducing exposure to more volatile daily spot prices. Most volumes for February were sold at a price determined during the last week of January. As freeze-offs occurred, many producers—more than just being unable to provide “swing volume”—could not even meet their base contractual volumes.

Power plants operate similarly. When they could not produce the contractually agreed-upon electricity to utilities and retail electric providers, they were forced onto the spot market to buy back the volumes that they were short. The February power price for ERCOT was set at about $24 per megawatt-hour. But as power plants scrambled to find electricity to “fill their shorts,” power prices rose quickly to the $9,000 per megawatt-hour cap set by ERCOT.

This started a death spiral and explains why the shortage became so expensive, so quickly, and why many Texans will see their highest-ever utility bills for February. Power plants found themselves looking for scarce molecules of gas that producers were also bidding on. Producers trying to maintain their contractual volumes were buying gas for $200 per million British thermal units to make up for volumes they had sold for $2.50. The main platform where energy products are traded, the Intercontinental Exchange, had to add space for another digit: no gas price had ever gone higher than $200 before. Close to Dallas, prices traded for more than $1,000 per million British thermal units.

Sitting in Utah in front of my laptop at 5 a.m. on Tuesday, I had never seen gas prices so high or moving so violently. Those in my industry usually argue over a cent. Now, trades were rising by fifty or a hundred dollars at a time. “Nothing” positions—small trades that those in the industry generally forget about and let expire—suddenly had the potential to make or break a year. “Boring” spread trades diverged to never-before-seen levels. In a situation where everyone was short, panic reigned.

Tens of billions of dollars were transferred around the industry, with what appears to be a somewhat random distribution of winners and losers. Some speculators made money; others lost it. Some power plants are now flush; others have already declared bankruptcy. Producers mostly lost—they were net buyers of daily gas, after all—but some in other parts of the country that experienced high prices but no freeze-offs made huge windfalls.

How could such a crisis have been avoided?

More gas would not have solved the whole problem. ERCOT would still probably have had to shed some load during the coldest hours of the crisis, when generation was falling short of demand by 30 gigawatts. However, had gas facilities been winterized and production stayed online, the blackouts might have been “rolled,” and lasted only a few hours per household, rather than days. We probably would not be using the word “crisis” so often.

Freeze-offs, unlike death and taxes, are not immutable facts of life. In the Bakken oil field in North Dakota, temperatures dropped to negative 25 degrees Fahrenheit a few days before the cold hit Texas, and producers there saw far less volume go offline than their Texan brethren when Midland temperatures were 20 degrees above zero. Texas gas producers could prepare for the next deep freeze, and ensure that power plants have access to more fuel. But there are compelling reasons to suggest that they won’t, unless they are required to do so.

One is obvious: Texas usually doesn’t get this cold. On average, only around 0.06 percent of total annual Texas gas production freezes off a year, and winterizing can cost more than $100,000 a well. Producers acted rationally, based on history, before the storm. Just as many Texans didn’t better insulate their pipes or wrap them in fiberglass ahead of the February storm, then saw them burst as temperatures finally rose, many oil producers determined that the benefits of winterization have not historically justified the costs. After this year, one might think that power plants, some of which could have made hundreds of millions of dollars were they able to run, and producers, who probably lost a couple billion collectively in buying back those volumes that they had promised to deliver but could not produce, would finally be eager to invest in winterization. But the severity and duration of February’s cold event was so extreme that it may be shrugged off as a freak event by market participants.

Even if the governor or state Legislature were to mandate that gas producers take steps to winterize their facilities, there are more than 250,000 active wells in Texas, including 100,000 in the Permian Basin alone. Not all of these wells produce much gas, and the distribution varies widely among those that do, but gas companies would need to spend billions of dollars to winterize even just the best producers, which they would be unlikely to do. Some might determine that the cost of winterization is too high, and that it would make more sense simply to abandon wells—resulting, ironically, in a reduction of supply.

In the weeks since the storm, several legislative fixes have been proposed, including lowering the electricity price cap and introducing a parallel market for “standby capacity,” where power plants are paid just for being ready to produce electricity, rather than only for actual production. But none of the potential fixes addresses the key issue: that Texas’s lightly regulated wholesale power system has been exposed as incredibly reliant on an even more lightly regulated gas production industry.

There are ways to increase reliability, but they will come at a cost. The cheapest and quickest way—more realistic than winterizing, given the economic incentives—would be to build more natural gas storage facilities. These could be funded by regulated gas utility companies, such as Dallas’s Atmos, Houston’s CenterPoint, and San Antonio’s CPS Energy, which in turn could pass on the costs to their consumers over a period of years. Storage facilities performed well during this latest crisis, and served as a vital source of supply as production froze off.

Second, some additional winterization equipment at power plants that were unable to operate—gas and wind, yes, but also coal and nuclear—would ensure that such facilities would be able to use whatever fuel was available. And, third, putting oil and gas production facilities on ERCOT’s critical infrastructure list more quickly will help ensure that those facilities retain power during rolling blackouts. During the winter storm, substantial volumes of production was lost not directly to freeze-offs, but because equipment lost power, causing a negative feedback loop of dwindling gas and power supplies.

While many native Texans might not like to hear a Yankee such as myself say it, this crisis was an unwanted side effect of the Grand Texas Bargain of low taxes, low spending, minimal oversight of public services by elected officials, and residents generally fending for themselves. Mitigating future crises demands technical and economic analysis, but the central question Texans must answer can be boiled down quite succinctly: Would you write a check tomorrow to prepare for another cold snap that might not come again in your lifetime? Or, phrased differently, will you or your plumber be crawling under your house to wrap your pipes?

- More About:

- Politics & Policy

- Energy

- Winter Storm 2021