Millions of Texans will feel the impact of the new federal tax law—even if most of the tax breaks for individuals only last through the end of 2025 and then revert to current law. That eventual repeal of individual tax cuts is designed as a kind of bait-and-switch to get Americans to support a permanent reduction of corporate taxes from a top rate of 35 percent to 21 percent.

President Trump and the Republican leadership of Congress say the bill will spur economic investment and job growth. A major tax break for corporations was not popular, though, and one recent poll found only a third of Americans believed they would benefit from the bill. So, Congress included the cuts for individuals as sweeteners. But enjoy your tax breaks while you can over the next eight years, because eventually there will be a piper to pay–i.e., possible cuts to Medicare, Medicaid and Social Security.

After Congress sent the measure to Trump today, he held a pep rally-like event at the White House with the Republican leadership. “It’s always a lot of fun when you win,” Trump said.

Now, the question is, did you win?

Home ownership tax deductions

Home mortgage and property for those who itemize have long been held out as incentives to home ownership in America—part of what once was considered the American Dream. These deductions always have been more meaningful to the middle class, but the new tax bill chips away at them.

In the past, the mortgage interest deduction was capped to interest paid on the first $1 million of a home loan. But the new tax bill reduces the cap to $750,000. That may seem like it’s still reserved for the truly wealthy, but as single family home and condo prices have gone up in Texas, you more and more often are finding people stretching to the limit to buy a home. The average home price in Austin earlier this year was reported to be $400,000.

So far in 2017, there have been 5,736 single family homes and condos purchased in Texas with mortgages that exceeded $750,000, according to ATTOM Data Solutions.

The average Austin property tax bill is $7,607, an increase of 21 percent over the past five years. For many homeowners, the rise in taxes is due to increased values, not new purchase prices. But rising values also mean that young people buying into the market are paying more. The ATTOM study found that in 2017, more than 320,000 single family homes and condos in Texas have sold for more than $10,000. Up until now, homeowners could deduct the state and local property taxes on their home and a vacation home from their federal taxable income. The new law limits the deduction to $10,000.

Both of these cuts may be offset by the fact that the standard individual deduction is being doubled to $12,000 for individuals and $24,000 for married couples. However, these standard deductions revert to current law in 2026, but the limits on deducting home mortgage interest and property taxes will remain. If property values continue to rise in Texas, many homeowners will find themselves paying more federal taxes in 2026 as the individual cuts vanish.

The more you earn, the more you get

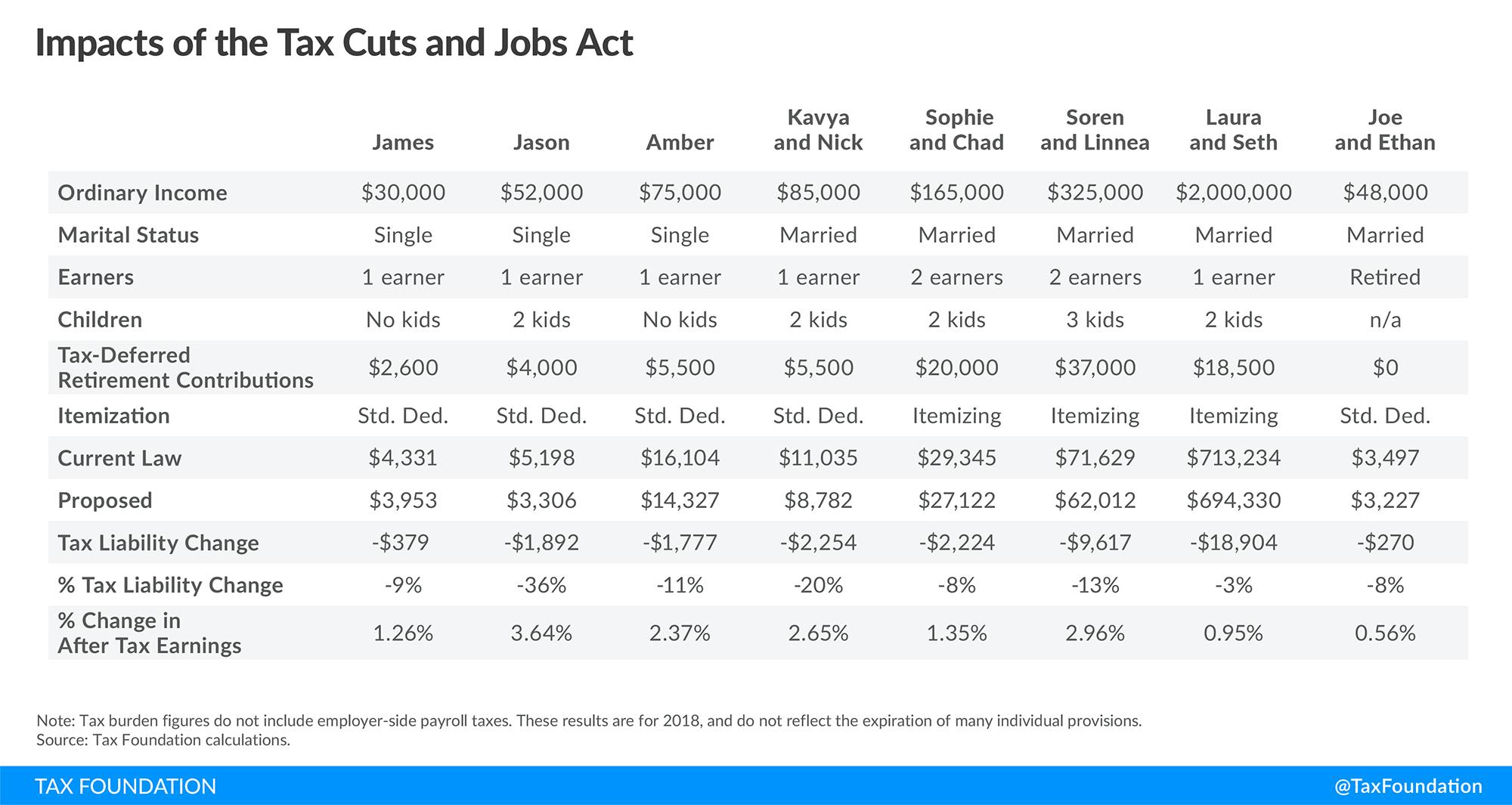

The Tax Foundation, a conservative tax policy nonprofit, supports the legislation, but even its chart on the impact of the tax bill on individuals in 2018 shows some of the income disparity in who gets how much next year. “The significantly higher standard deduction, combined with lower marginal rates and a more generous (and more broadly available) child tax credit, drives the reductions in tax liability for low- and middle-income filers,” the foundation reported. “A reduction in itemized deductions limits reductions in tax liability for upper-income earners, though these filers benefit from the modified alternative minimum tax and lower top marginal rates.”

Click on the chart to expand it:

The Tax Foundation also noted that because the individual cuts are temporary, the numbers do not represent what an individual’s tax bill likely would be over a ten-year period.

Private school savings accounts

So maybe a taxpayer takes a bit of a haircut on their property taxes, but those who plan to send their children to private or religious schools will pick up a bit of a break from an amendment by Texas senator Ted Cruz. It will expand the 529 college savings accounts to include payments to private schools, from kindergarten to secondary schools. Originally, it also included homeschool, but that was taken out because of procedural problems in the Senate. The legislation will allow parents to use up to $10,000 a year from a tax-exempt account to pay for private school tuition and expenses.

Estate tax

Currently, estates valued at less than $5.6 million are exempt from federal estate taxes. Under the new law, that will double. The Tax Foundation estimates this one cut will cost the federal government $72 billion over ten years.

Republicans often portray repealing the “death tax” as a protection for the family farm or small business. A Congressional Budget Office report once found that most either were structured to avoid the tax or fell under the exempt amount. This really is a tax on the extremely wealthy.

Texas in 2016 ranked fourth for the number of estate tax returns filed. In 2016, there were 736 estates that had gross values subject to the tax, but only 301 owed taxes, with a combined payment of $1.1 billion. Nationally, stocks made up more than half of all the estate holdings.

Even this break for the rich will expire in December 2025. One joke making the rounds is that December will turn into Throw Momma from the Train with wealthy families hoping to qualify under the new estate tax bracket before it expires.

Health Care

The new law repeals the individual mandate that requires individuals to pay a penalty if they do not have health insurance. That penalty payment helps subsidize the cost of providing health insurance to those who buy a marketplace policy under the Affordable Care Act, also known as Obamacare.

In tax year 2014, a million Texas households paid a combined $247.5 million in individual mandate penalties, according to Tom Price, the U.S. health and human services secretary. Since “Obamacare was implemented, health insurance premiums on the individual market in Texas have risen 82 percent—more than $2,100 per year,” Price wrote in an op-ed earlier this year. “With prices skyrocketing, it is no wonder that 1 million Texans paid a penalty in exchange for nothing instead of scraping together the resources to buy an Obamacare plan.” The New York Times recently reported that Texas—with the highest percentage of uninsured people in the nation—has the highest percentage of people paying the penalty for not buying insurance.

Cruz was among the Senate leaders pushing for the repeal of the individual mandate. He claims it penalized people who could not afford to buy health insurance.

It’s not that simple, though. No one really knows why people are paying the penalty instead of buying health insurance. One theory is that healthy young people just pay the penalty instead of paying more money for health insurance. Another is a problem with the ACA: if an employer provides health insurance that only covers the employee, the family is not eligible to buy subsidized insurance in the marketplace and therefore may not be able to afford to buy insurance and instead will have to pay the penalty. And in October, the Kaiser Family Foundation surveyed a group of uninsured people in Florida and Texas and found that 68 percent did not know when they could enroll for subsidized health care for 2018.

However, the ACA this year did provide health insurance for 963,171 people in Texas, 86 percent of whom received subsidies. The percentage of uninsured Texans dropped from 23 percent in 2013 to 17 percent in 2016. The new tax law makes the future uncertain for them. The Congressional Budget Office predicted that thirteen million Americans would lose health insurance by 2027 if the individual mandate is removed.

Texas’s senior senator, Republican John Cornyn, told reporters in Washington this week that removing the individual mandate will force Democrats to negotiate changes for the future. “Arguably, doing away with the individual mandate makes the Affordable Care Act unworkable—not that it was particularly great beforehand,” Cornyn said. “So I think ultimately this will precipitate a bipartisan negotiation on what we need to do as an alternative.”

The individual mandate does not go away until January 1, 2019, so if you haven’t signed up for health insurance for 2018, you’ll still owe the penalty when you file your federal income tax return in April.

Income inequality

This tax bill has a little something for just about everyone in it, but it is fairly clear that the lower you are on the socio-economic ladder the littler that something is.

The left-leaning Urban-Brookings Tax Policy Center reported that the bill will give a tax break to just about all Americans, but the richest will receive the most: “In general, higher income households receive larger average tax cuts as a percentage of after-tax income, with the largest cuts as a share of income going to taxpayers in the 95th to 99th percentiles of the income distribution. On average, in 2027 taxes would change little for lower- and middle-income groups and decrease for higher-income groups. Compared to current law, 5 percent of taxpayers would pay more tax in 2018, 9 percent in 2025, and 53 percent in 2027.”

As expansive as this bill is, I just could not go into every detail. If you have a favorite that I left out, please, include it in the comments, or feel free to contact me at [email-hidden] or 512-320-6971.