Texas doesn’t have a mile-high city, but Fort Davis comes close, at 4,892 feet. The tiny unincorporated town is nestled in the foothills of the Davis Mountains, where bears and mountain lions and elk stalk among pine-forested sky islands. Fort Davis is the seat of Jeff Davis County, whose population of 1,996 is spread among 2,265 square miles, an area more than twice the size of Rhode Island. The sparsely populated desert nation of Mongolia has nearly seven times the population density of Jeff Davis. Odessa, the nearest sizable city to Fort Davis, is two and a half hours away. The state capitol is six and a half.

For Graydon Hicks III, the far-flung-ness of Fort Davis is part of its appeal. He likes the high and lonesome feel of his hometown—the “prettiest in Texas,” he says. But these days it has never felt farther from the state’s political center of gravity.

For years Hicks, the superintendent of Fort Davis ISD, has been watching helplessly as a slow-motion disaster has unfolded, the result of a deeply flawed and resource-starved public school–finance system. Over the past decade, funding for his little district, which serves just 184 students from pre-K through twelfth grade, has sagged even as costs, driven by inflation and ever-increasing state mandates, have soared. The math is stark. His austere budget has hovered at around $3.1 million per year for the past six years. But the notoriously complex way the state finances schools allows him to bring in only about $2.5 million per year through property taxes.

Hicks has hacked away at all but the most essential elements of his budget. More than three quarters of Fort Davis’s costs come in the form of payroll, and the starting salary for teachers is the state minimum, just $33,660 a year. There are no signing bonuses or stipends for additional teacher certifications. Fort Davis has no art teacher. No cafeteria. No librarian. No bus routes. The track team doesn’t have a track.

But Hicks can’t cut his way out of this financial crisis. This school year, Fort Davis ISD has a projected $621,500 funding gap. To make up the difference, Hicks is tapping into savings. Doug Karr, a Lubbock school-finance consultant who reviewed the district’s finances, said Fort Davis ISD was “wore down to the nub, and the nub’s all gone. And that pretty much describes small school districts.”

“I am squeezing every nickel and dime out of every budget item,” Hicks said. “I don’t have excess of anything.” When I joked that it sounded like he was holding things together with duct tape and baling wire, he didn’t laugh. He said, “I literally have baling wire holding some fences up, holding some doors up.”

The district’s crisis comes at a time when the state is flush with an unprecedented $32.7 billion budget surplus. Hicks is a self-described conservative, but he thinks the far right is trying to destroy public education. For years, the state has starved public schools of funding: Texas ranks forty-second in per-pupil spending, according to Raise Your Hand Texas, a pro–public education nonprofit founded by H-E-B chairman Charles Butt. And yet Governor Greg Abbott is spending enormous political capital on promoting a school-voucher plan, which would divert taxpayer funds to private schools. Public education, Abbott has repeatedly said, will remain “fully funded,” though public-education spending is projected to be lower this year than when he took office, in 2015, and the Legislature recently passed a $321.3 billion budget with no pay raise for teachers and very little new funding for schools. Unable to get his voucher plan through the regular legislative session, Abbott is threatening to call lawmakers back to Austin until he gets his way.

Lieutenant Governor Dan Patrick, long a champion of vouchers, has backed legislation that would attempt to appease rural Republican legislators—a bloc long wary of vouchers—by offering $10,000 for every student that small districts lose to private schools. Hicks can barely contain his anger when he hears such talk. He has been lobbying state leaders for years to fix the crippling financial shortages that plague districts like his. “Take your assurances and shove ’em up your ass,” he says, before softening a bit. “I’m so tired. I’m so frustrated. We have tried. I have fought and fought and fought.”

With each passing month, his rural district inches closer to financial ruin. If nothing changes by fall of next year, Fort Davis will have depleted its savings. He doesn’t know the exact day that his schools will go broke, but he can see it coming.

It’s easy enough to grasp the basic problem in Fort Davis. But what’s going on beneath the surface is another story.

During my twenty years of reporting on Texas politics, I’ve often heard that only a handful of people in the state understand the school-finance system, with its complicated formulas, allotments, maximum compressed rates, guaranteed yields, and “golden pennies.” A former colleague of mine, who once spent months trying to make sense of the topic, warned me against writing about it. Karr, the school-finance consultant, compares the process of making sense of our public-education funding to encountering a fire at a roadside cotton gin on some lonely West Texas highway. “You drive off into that smoke, and you might never drive out,” he said. “You might end up getting killed.”

A thorough explanation of the system is the stuff of graduate theses, but the broad strokes are straightforward enough. How a school district is funded begins with two key questions: How much money is the district eligible for? And who pays for it?

Here it’s helpful to use a venerable school-finance analogy: buckets of water. The size of a school district’s bucket—how much money it’s entitled to—is largely determined by the number of students in attendance. Every district receives at least $6,160 per pupil, an amount known as the basic allotment, an arbitrary number dreamed up by the Legislature and changed according to lawmakers’ whims.

From there, the Texas Education Agency (TEA) adjusts for the widely variable costs of kids’ educational needs. For example, districts get extra for special ed students, bilingual students, and dyslexic students. Additional funding is available for fast-growing districts (which struggle to keep up with the costs of growth) and small ones (which lack economies of scale). The resulting number, the so-called Tier I entitlement, represents what the state believes to be sufficient funding for each district to provide a basic education to its students.

Next comes the question of who pays. The $64 billion public-education system, which accounts for a higher percentage of the state’s budget than any other function, has long been built on a partnership between local communities and the state. Currently local taxpayers put in about 53 percent, the state contributes 38 percent, and the feds pick up the remainder. But those are averages across the whole system. At the individual district level, the shares can vary considerably. Property-poor districts may not be able to generate enough tax dollars to pay for their entitlement—to fill up their bucket. In that case, the state will make up the difference. Property-wealthy districts, on the other hand, may be able to cover their entitlement with no state contributions and still have a lot remaining, some of which can be spent locally and some of which is sent to the state for redistribution to poorer districts. Their buckets runneth over.

Hicks, the Fort Davis superintendent, is a student of this byzantine framework. He has to be. Many small-district superintendents can’t afford CFOs and must figure out how to squeeze every penny out of a stingy system.

To explain how the system has failed Fort Davis, Hicks referred to several spreadsheets. One of them was built by Omar Garcia, an investment banker who previously worked for the Texas Education Agency, helping school districts estimate state financial aid. (In school-finance circles, Garcia has achieved first-name-only status, with one official calling him a genius in a 2022 tribute video.) The Omar spreadsheet includes at least 120 linked worksheets, with names such as M&ODetail2223-HB3: it’s a dizzying concatenation of data, formulas, and variables derived from the decades-long accretion of law that accumulates in layers, like an ancient archaeological site. Following the money through the interlocking spreadsheets can be maddening. “What reasonable person would say this makes sense?” says Hicks. “It’s totally bizarre.”

Hicks thinks the opaqueness is intentional, a view shared by others. “They make it just as complicated as they can,” he said of state officials. “Because how do you explain something so complicated to the average voter?” In other words, if constituents can’t easily grasp the perplexing and unnecessarily knotty framework, it’s tougher to hold officials accountable for budget decisions.

Though the spreadsheets may be head spinning, they tell a story. In a state where some wealthy suburban communities build $80 million high school football stadiums, Fort Davis is one of many rural districts literally struggling to keep the lights on.

I first heard from Hicks in March 2021, when he emailed state officials and journalists with a dire message: “What, exactly, does the state expect us to do? What more can we do? What more do our children need to be deprived of? At what point does our community break?” Hicks has received few answers, even as his situation has grown more desperate.

When I visited him in April, we met in his office, where he keeps a book on Texas gun laws, a photo of his West Point 1986 graduating class (which included Donald Trump’s secretary of state Mike Pompeo), and a list of quotes from General George Patton (“Genius comes from the ability to pay attention to the smallest details”). Hicks, who’s stout and serious and talks in a sort of shout-twang because of partial hearing loss, wore a cross decorated in the colors of the American flag. He was eager to show me the fine line he walks between fiscal prudence and dilapidation. The first lesson came as he stood from his desk and I noticed the holstered handgun on his hip. The district, he explained, can’t afford to hire a school-security officer, so he and eleven others carry firearms.

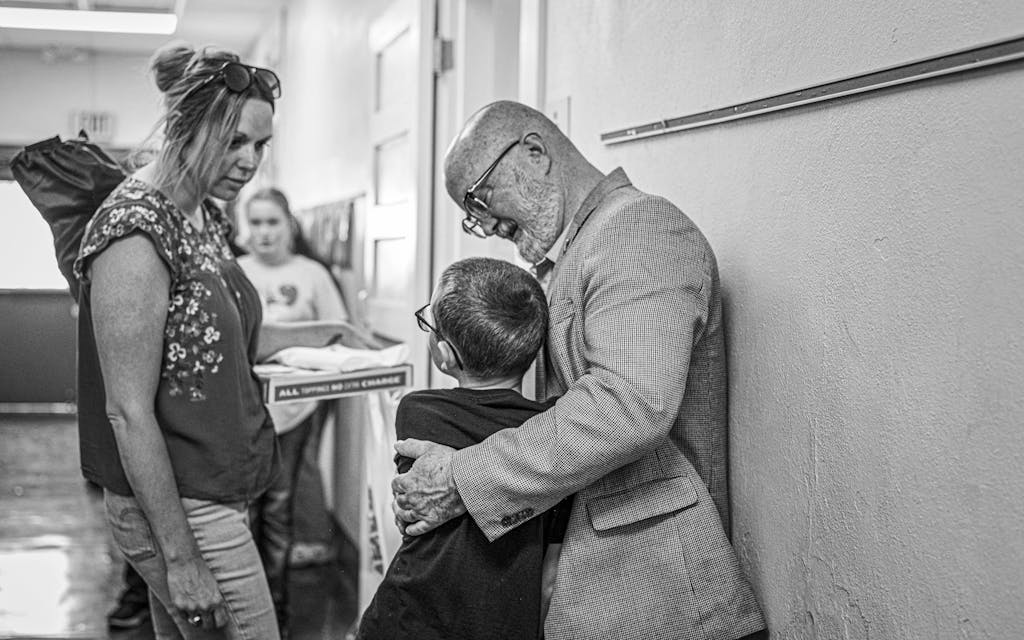

His family has been in the area since the 1870s, when federal soldiers still pursued Comanche and Apache from the town’s namesake garrison. His great-uncle was one of the first superintendents of Fort Davis ISD. (At one point, Hicks showed me a copy of his great-uncle’s 1942 master’s thesis, “The Early Ranch Schools of the Fort Davis Area.”) Later, as we were walking around the elementary campus, Hicks’s ten-year-old grandson, a thin fourth grader wearing blue-rimmed glasses and blue jeans tucked into a pair of cowboy boots, ran up to Hicks and gave him a hug.

Both the elementary school and the high school—where Hicks graduated in 1982—were built in 1929, he explained. Walking through their timeworn hallways is stepping back in time. In places, the plaster is flaking off the original adobe walls. The elementary school gym floor is bubbling up because of a leak under the foundation. The wooden seats in the high school auditorium have never been replaced. The urinals in the elementary school are original too. The newest instructional facility, a science lab, was built in 1973. Hicks himself periodically mows the football field, the same one he played on five decades ago. “Every bit helps,” he said.

The funding challenges create all manner of ripple effects. Hicks has trouble recruiting and retaining teachers, and some students drift away from school without extracurriculars to hold their interest. “You can’t get teachers. Then you start losing kids, and then your funding gets worse,” he said. “It’s a circle-the-drain kinda thing. And it’s really speeding up for Fort Davis.”

The first problem is the size of the district’s bucket. For the past decade, TEA has calculated that Fort Davis’s Tier I annual allotment is between

$2 million and $2.5 million, well short of its already spartan $3.1 million budget.

And then there’s the matter of how that bucket is filled. In the 2011–2012 school year, the state covered two thirds of Fort Davis’s entitlement, about $2.14 million. Today it chips in about $158,000, a 93 percent decrease. How to explain that change?

The causes are many, but each of them points to systemic problems with the current school-finance system. Like many districts, Fort Davis ISD is coping with the fallout from COVID-19. Some students never returned to school after the pandemic; others have spotty attendance. Texas is one of the few states that provide funding based on attendance rather than enrollment. When a student leaves or misses classes, the district loses dollars. Schools across the state are getting hammered by a drop in enrollment, but small districts are particularly vulnerable—every student lost represents a higher proportion of total revenue.

The state allows districts to raise more money by levying an additional tax of as much as 17 cents per $100 of property, so-called enrichment or Tier II funding. Fort Davis generates as much as it can through Tier II, about $270,000 or so, before it runs into yet another limitation: because the district is considered property rich, it has to send money back to the state beyond a certain point. Enrichment funding gives Fort Davis the ability to add to its bucket, but not enough to meet its needs.

Property values are yet another complication. In Fort Davis, they have almost doubled since 2016. Given that Texas schools are funded in large part by local property taxes, that would seem to represent a windfall for Fort Davis ISD. But in fact it has had the opposite effect.

As property values have soared, state aid has dwindled. That’s by design. “TEA doesn’t judge a school district’s wealth by how much money they’ve got in the bank. They judge it by the property value,” said Karr. “And so when a school district’s property value is going up, TEA takes the perspective that those people are getting wealthier because they’ve got more taxable wealth.”

The idea is that soaring property values will yield more local tax dollars, and state aid isn’t needed as much. But the reality is far different in Fort Davis and some other rural districts. Part of the problem is that the local appraisal district and the state comptroller can’t agree on the value of property in the county. For example, for the current school year, the Jeff Davis Appraisal District pegged the total value of property in Fort Davis ISD at $233.4 million. But the comptroller found it was 22 percent higher than that, or $284.4 million.

And here’s the rub: when the comptroller determines that property values are significantly higher than the local estimate, the Texas Education Agency must, by law, side with the comptroller. This produces a “double whammy,” says Bob Popinski, the senior director of policy at Raise Your Hand Texas. TEA determines what it thinks the district needs based on the higher comptroller value, thereby reducing the amount of state aid, but the district can collect taxes only on the lower amount.

Nearby Alpine ISD is facing a similar problem, its superintendent, Michelle Rinehart, told me. Over the past two years, because of disagreement over property values, Alpine schools lost nearly $1 million from the state—a significant sum for a cash-strapped district with a $10 million budget. The bottom line: the state treats districts like Fort Davis and Alpine as if they were rich when they’re actually quite poor. And this state of affairs is particularly remarkable given that just a few years ago state leaders were touting a supposedly generational investment in public education.

In June 2019 the Big Three figures in state government—Abbott, Patrick, and then–House Speaker Dennis Bonnen—gathered at an elementary school in Austin for an almost giddy bill-signing ceremony. As a bipartisan group of lawmakers watched, Abbott signed into law House Bill 3, an $11.6 billion package of property tax cuts and education funding that had received near-unanimous support in both the House and Senate, a rarity in the highly polarized Legislature. “This one law does more to advance education in the state of Texas than any law that I have seen in my adult lifetime,” said Abbott.

For almost a year, an appointed commission of experts had met to discuss how to overhaul the school-finance system, issuing a report in December 2018 that called on the Lege to “redesign the entirety of our state’s funding system to reflect the needs of the 21st century.” HB 3 was the by-product of that prompt. Lawmakers rejiggered many of the system’s outdated formulas, offered pay raises to teachers, fixed some of the most glaring inequities, and reduced the amount of money recaptured by the state from property-

wealthy districts. Most important, HB 3 represented a much-needed infusion of cash for struggling schools. The basic allotment was raised from $5,140 to $6,160 per student.

But HB 3 also exacerbated disparities among property-wealthy and property-poor districts. Because of changes to the way Tier II enrichment funding works, some communities were able to cut tax rates and generate significant new revenues from their tax base. For others, a minority of districts, HB 3 created new problems. This year Alpine has $220,000 less than it would have had under the old system, even as some of the richest districts in the state—tiny West Texas communities with lots of oil wealth—saw their funding explode.

Rinehart contrasts Alpine, which has almost no mineral wealth, with Rankin ISD, 120 miles northeast in the Permian Basin oil patch. While Alpine’s funding went down 2 percent, Rankin’s went up 339 percent. Even though Rankin is projected to return close to $100 million in recapture payments to the state this year, the district is fabulously wealthy. “Alpine’s budget is ten million,” Rinehart points out. “Rankin’s is fourteen million. We educate a thousand kids, and they educate three hundred kids. So they are a third of our size and have a budget forty percent larger than ours.”

Rinehart doesn’t begrudge Rankin’s wealth—she recently served as assistant superintendent there—but uses the Alpine-Rankin comparison as a “wild” example of how HB 3 exacerbated inequities, making the rich richer and the poor poorer.

Hicks, too, has noticed. “Rankin just built a whole new school,” he told me. “They got a new field house, a new gym. Two new science labs. A turf practice field, a turf game field. A new track, a new stadium. And my buildings were built in 1929.” Rankin is planning to build at least ten new “teacherages”—district-funded housing for teachers, important for attracting and retaining talent in areas with scant or unaffordable residences.

Jeff Davis County, on the other hand, has no oil and gas and very little industry; any school debt would thus be borne by homeowners, through bonds. Hicks’s district has never held a bond election, in part because it would be unlikely to succeed; the voters wouldn’t support a tax increase. The high school’s ag barn was built in 2019 with local donations. The band program, suspended for nine years as a cost-saving measure, was revived only in 2023, after a philanthropist left his estate to the school.

To be sure, Alpine and Fort Davis are outliers. Most districts saw an immediate boost to their finances from HB 3, and advocates celebrated a meaningful investment in public education after $5.4 billion in devastating statewide cuts in 2011. But even for those districts, the sugar rush from HB 3 didn’t last long. Chandra Villanueva, the director of policy and advocacy at the progressive nonprofit Every Texan, wrote in an online post that the $1,000 increase in the basic allotment was “roughly enough to cover one year of inflation.”

“We were better off after House Bill 3 than we were before House Bill 3,” said Paul Colbert, a former state legislator who has spent fifty years working on school-finance issues. “But to claim that it solved our problems was a giant overstatement of the case. All it did was get us back to where we had been four years earlier.”

Colbert was one of the chief architects of the modern system of school finance, assembled in 1984, when the wonkish Houston Democrat was serving in the Texas House. Today the 73-year-old works as a lobbyist for El Paso ISD and, more informally, as a walking wiki of school-finance history. At the Capitol, he has been shopping around some eye-watering facts and figures, the product of his rooting around in TEA data.

What Colbert has found is that state support for Texas’s thousand-plus independent school districts has been flat for the past decade, even before adjusting for inflation. (State aid for charter schools has exploded, but that’s another story.) In 2014 the state contributed $16.6 billion in maintenance and operations funding; in 2022 it put in $16.9 billion, with the amount projected to fall to $14.9 billion in 2023, a particularly alarming figure given soaring inflation. When a lawmaker presented this stat at a legislative hearing in February, another legislator could be heard letting out a “wow.”

The Legislature, largely unbeknownst to the public, has devised a system in which it disinvests in public schools while putting an increasing burden on local taxpayers. Another Colbert fact: the state share of funding to ISDs has fallen from 44 percent in 2011 to 31 percent in 2022. More and more, the tab is picked up by unwitting homeowners, renters, and business owners.

The Legislature has a plan for this too. Intent on providing property tax relief, lawmakers in 2019 plugged in a perpetual motion machine, forcing school districts to ratchet down their tax rates as property values grow. Consider Fort Davis ISD. In 2019 it taxed at the maximum rate allowed under state law—$1.17 per $100 of property value, or $2,340 a year on a $200,000 home. Today Fort Davis’s tax rate is $0.97 per $100 of value, and it could drop to $0.87 this year. “Tax compression,” as it’s called, sounds like a beautiful thing. That is until you study the fine print.

For one, compression doesn’t do anything for public education and may in fact harm it in the long run. Though the state pledged to make up the lost revenue—at a cost of $5 billion over two years—tax compression puts no new money into schools. And from Hicks’s perspective, it takes away his ability to raise money from the local community. “They pulled the rug out from underneath me for local collection ability. I don’t have any control,” he said.

This budgetary legerdemain is largely unknown to local taxpayers, says Villanueva. As a result, instead of blaming legislators, they look locally for the culprits. “You’re paying more and more in property taxes every year, but your schools aren’t getting any better,” he says. “Your schools are still threatening to close. They can’t hire enough teachers. They’re in financial distress all the time. So almost by design, it creates distrust for both the school system and property taxes.”

The property tax system and the school-finance system are inextricably linked, Rube Goldberg–style. Twist a dial here and a light will come on over there. Slip a gear here and spring a leak there. As state lawmakers have prioritized tax cuts over public-education funding, the trade-offs have grown clearer. This year represents a potential turning point. But rather than trying to solve the problem using the $32.7 billion budget surplus—a generational bonanza—Abbott and Patrick have overwhelmingly focused their attention on property tax cuts and a school-voucher plan loathed by almost everyone in public education, in part because it would threaten to strip even more funding from school districts.

The Eighty-eighth Legislature’s regular session was a bloodbath. It began in January, and the governor and lieutenant governor promised to pass a transformative voucher program and historic property tax cuts. Funding for public education, often a banner issue, was scarcely discussed. Even the House, the friendlier chamber toward public education, proposed raising the basic allotment by only $140, from $6,160 to $6,300 per student by 2025—far less than the $1,500 increase needed to keep up with inflation since 2019, according to the Texas American Federation of Teachers. But in the end, teachers and public schools got virtually nothing.

Teachers and administrators were stunned. Zeph Capo, the president of the Texas affiliate of the American Federation of Teachers, called it a joke. H. D. Chambers, the executive director of the Texas School Alliance, accused Patrick and Abbott of playing a “hostage game” with Texas’s teachers by tying education funding to vouchers. “It’s pretty simple. The governor and Senate says, ‘If you don’t give us the kind of vouchers we want, we’re not giving you any money.’ ” The House refused to budge, and the regular session concluded without a deal on property tax relief, vouchers, and other GOP priorities.

Then the governor promised to convene multiple special sessions to take up the unresolved issues. The first special session began three hours after the regular one ended and effectively wrapped up less than 24 hours later, with the House rejecting the Senate property tax plan, passing its own program consisting solely of property tax compression, and then abruptly adjourning. Abbott threw his support behind the House plan. The message to the Senate was clear: take it or leave it. If the Senate yields, the House version would push some school districts down to as little as 60 cents per $100 of property value, with no new source of revenue to backfill for the reduced funding in case of a bad economy. (When this article went to press, a deal had yet to be reached.)

Abbott has said his goal is to completely eliminate the main school property tax. In such a scenario, Texas’s school districts would be at the mercy of the Legislature for funding—a troubling scenario, says Villanueva. She suspects vouchers would then become inevitable. “At that point, it’s like, ‘You know what, we don’t have the money to fund schools. Everyone take five thousand bucks and go figure it out for yourselves.’ ”

That day, if it ever comes, may still be far off. But the education system is in crisis right now, and unlike during previous hard times, the state is flush with cash. The pain, Chambers says, is being intentionally inflicted by Abbott and Patrick. “Because of this one pet project that the governor has”—vouchers—“they are purposely creating a financial environment where every school district in Texas is being set up to fail.”

The result is that Texas schools, already operating on “shoestring budgets,” will have a harder time attracting and retaining educators, said Josh Sanderson, the deputy executive director of the Equity Center, a nonprofit that represents more than six hundred Texas school districts. They will run up deficits. They may have to cut extracurriculars and athletic programs. Some, like Fort Davis, may become insolvent and be forced to consolidate with another district, a painful process.

Hicks has gone so far as to devise his own school-finance system. Idiosyncratic though it may be, it contains elements that many school-finance experts say are important fixes: a more generous basic allotment that automatically increases based on inflation, more-realistic formula funding based on the real-world costs of education, and the inclusion of bond revenues in the state’s determination of whether a district is rich or poor.

As we were sitting outside his office in his red pickup with the engine idling, Hicks told me that he’d given up on lobbying the Legislature. He mentioned again that Patrick and other GOP lawmakers are trying to destroy public education by using vouchers to privatize schools, and he said that most other politicians “don’t give a s— about West Texas.” But for the time being he was still fighting: writing op-eds, firing off plaintive missives, asking concerned citizens to contact their legislators.

Toward the end of our visit, I asked Hicks what’s going to happen to his schools. “I don’t know,” he said. “I’m not patient enough to spend time with assholes in Austin, and I’m not rich enough to buy any votes.” TEA has suggested that Fort Davis consolidate with another district—most likely Valentine, which is 35 miles away—but Hicks said both districts would suffer for it.

He seemed resigned to his role as a Cassandra warning of impending doom, destined to be ignored. He reminded me that his grandson goes to school here and that the painful road ahead feels both personal and existential. “If you don’t have a school,” he said, “you don’t have a community.”

Two months later Hicks called me with some news. He’d decided to retire this summer, joining the mass exodus of school leaders who have fled the profession in the past few years. To anyone who closely follows public education in Texas, his reasoning was tragically familiar: he said he was too tired to fight anymore.

An abbreviated version of this article was published online on June 6, 2023. It appeared in the August 2023 issue of Texas Monthly with the headline “Going for Broke.” Subscribe today.

- More About:

- Public Schools

- Longreads

- Fort Davis