Earlier this month, Houston’s Post Oak Motor Cars—a luxury car dealership owned by billionaire businessman Tilman Fertitta—announced that it would begin accepting payment in Bitcoin for its fleet of Rolls-Royces, Bentleys, and Bugattis. The first buyer was Ken Bridge, owner of Houston restaurant group Delicious Concepts, who picked out a black Bentley Continental GT (MSRP: $201,225—or approximately thirty Bitcoins at the current price of $6,700 per coin). For now, Bridge remains the only person to have used Bitcoin to purchase a car from Post Oak, but there have been other inquiries.

Then, on September 24, Chinese Bitcoin mining company AntPool announced that it would be sponsoring the Houston Rockets for the 2018-19 season as part of its expansion into the American market. The Rockets, of course, were purchased just last year by Fertitta, who says that he turned down multiple previous cryptocurrency sponsors for the team before approving AntPool.

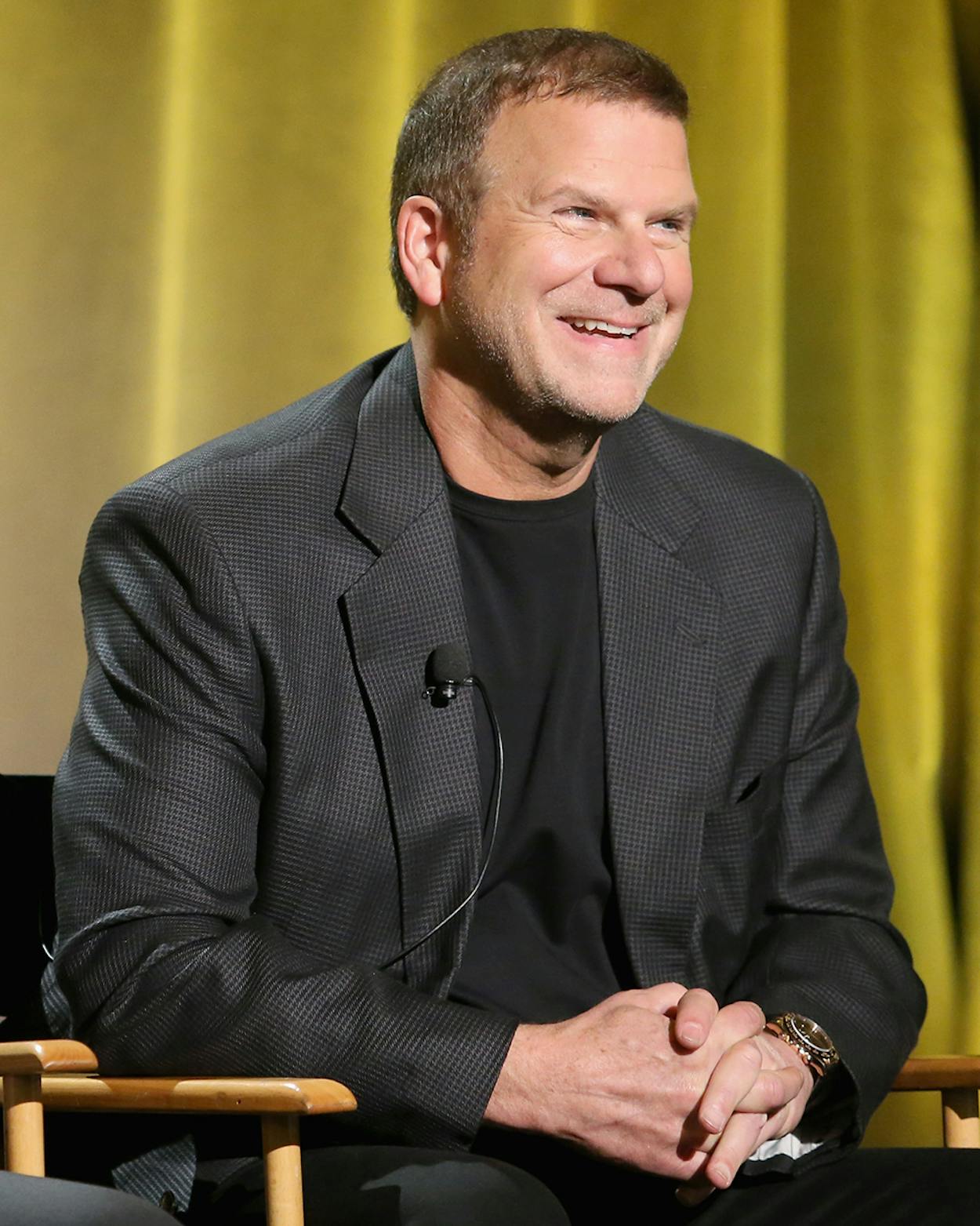

In conversation with Texas Monthly, Fertitta described his longstanding interest in cryptocurrencies and his plan to roll out Bitcoin payment to more properties in his portfolio of Golden Nugget casinos and Landry’s restaurants.

Texas Monthly: What first got you interested in cryptocurrency?

Tilman Fertitta: You have to remember, I’m in a business where I try to stay on top of anything that’s new. Look at how much things have changed, at all the new industries out there. The companies that don’t grasp the new world are not going to last. We looked at Bitcoin and realized, this is something that’s going somewhere. And if we’re going to do it, we’re not going to be a follower, we’re going to be a leader. If I did not have a cryptocurrency expert here in house [analyst Trey Zeluff], we wouldn’t be as aggressive. If you’re going to do this, you better have somebody that really knows what they’re doing.

TM: Why did you decide to accept Bitcoin at Post Oak Motor, and do you have any plans to roll it out to any of your other properties?

TF: Yeah, absolutely—this was just the beginning. We felt like nobody had done it at all for this kind of dealership. You’re selling a lot of these cars to younger people today, and we felt like it was something that would maybe be attractive to them.

TM: Can you envision the day when Bitcoin is accepted in one of your casinos or restaurants?

TF: I see it happening sooner rather than later. We’re working on projects right now.

TM: There’s a large, passionate cryptocurrency community. What kind of response have you received from them?

TF: It’s been huge. I get Google News alerts every day, and I think there have been a hundred articles written about this. I had no idea—it totally shocked me. That’s not why we did it, but it just shows there’s a lot of interest in Bitcoin and cryptocurrency.

TM: Do you personally have substantial holdings in Bitcoin or any other cryptocurrency?

TF: I have some holdings in Bitcoin, but only Bitcoin. My son Michael is a pretty big trader of Bitcoin. He’s done well with it. He’s been in it for ten years, almost since the inception.

TM: So he’s made a pretty penny.

TF: He has. But he’s good at that kind of stuff. He read the white papers about it a long time ago.

TM: A lot of people worry about how unstable Bitcoin seems. Its value seems like a roller coaster sometimes.

TF: It’s like a stock on the New York Stock Exchange. That’s what everybody forgets. If you look at the percentages, I can show you stocks that trade in the same range. Your naysayers are always going to be negative, but that’s just the world of any currency. Look how the euro has been trading in the last three weeks—all the way down to $1.12 and back up to $1.20.

TM: Yeah, but nowhere near the range of quadrupling or quintupling in value the way Bitcoin has.

TF: No, I agree. But that’s because right now, every time an analyst report comes out it has a huge effect. People are trying to figure out, how real is this? When we announced that we were taking Bitcoin [at Post Oak Motor] there was a small tick up that people attributed to that. So if we can have an impact, that ought to tell you something. Remember, every week, every month that goes by, that trading range will get smaller and smaller as people understand it better.

TM: So this isn’t a gimmick. You’re in it for the long term.

TF: You know me—I’m not a gimmick kind of guy. I don’t do gimmicks.